1 March 2022

What is trend following?

Trend following is a systematic investment strategy that seeks to make money from price trends, up or down, in stock markets, government bonds, interest rates, commodities and currencies.

Price trends have been a feature of global financial and commodity markets throughout history, with markets rising and falling over multi-year periods (see examples below).

Trendy Behaviour: A Consistent Feature of Global Markets

These trends can be due to factors ranging from technological innovation and shifts in demographics to geopolitics and investor behaviour. Trend-following strategies do not need to understand why a market is trending; instead, they are designed to profit from trends as and when they emerge.

How Does Trend Following Work?

Trend-following strategies seek to profit from the tendency for markets to trend by consistently applying rules-based trading systems to many different markets.

The trading systems are designed to identify the beginning and end of price trends, while sizing positions so that they are proportionate to the strength of the price trend and the riskiness of the market.

The strategy takes both “long” positions (those designed to profit from rising markets) and “short” positions (those designed to profit from falling markets).

Rules-Based Trading Systems Determine Direction in a Market

The consistent application of these trading systems to many markets is important. Trends in an individual market can be few and far between. By following trends in many markets at the same time, the strategy benefits from a diversification effect that results in a more consistent return profile.

Why Invest in Trend Following?

Many of the world’s most sophisticated institutional investors have been investing in trend-following strategies for decades. The primary reason for doing so is that the strategy offers valuable diversification for other investments, particularly traditional stock market and bond holdings.

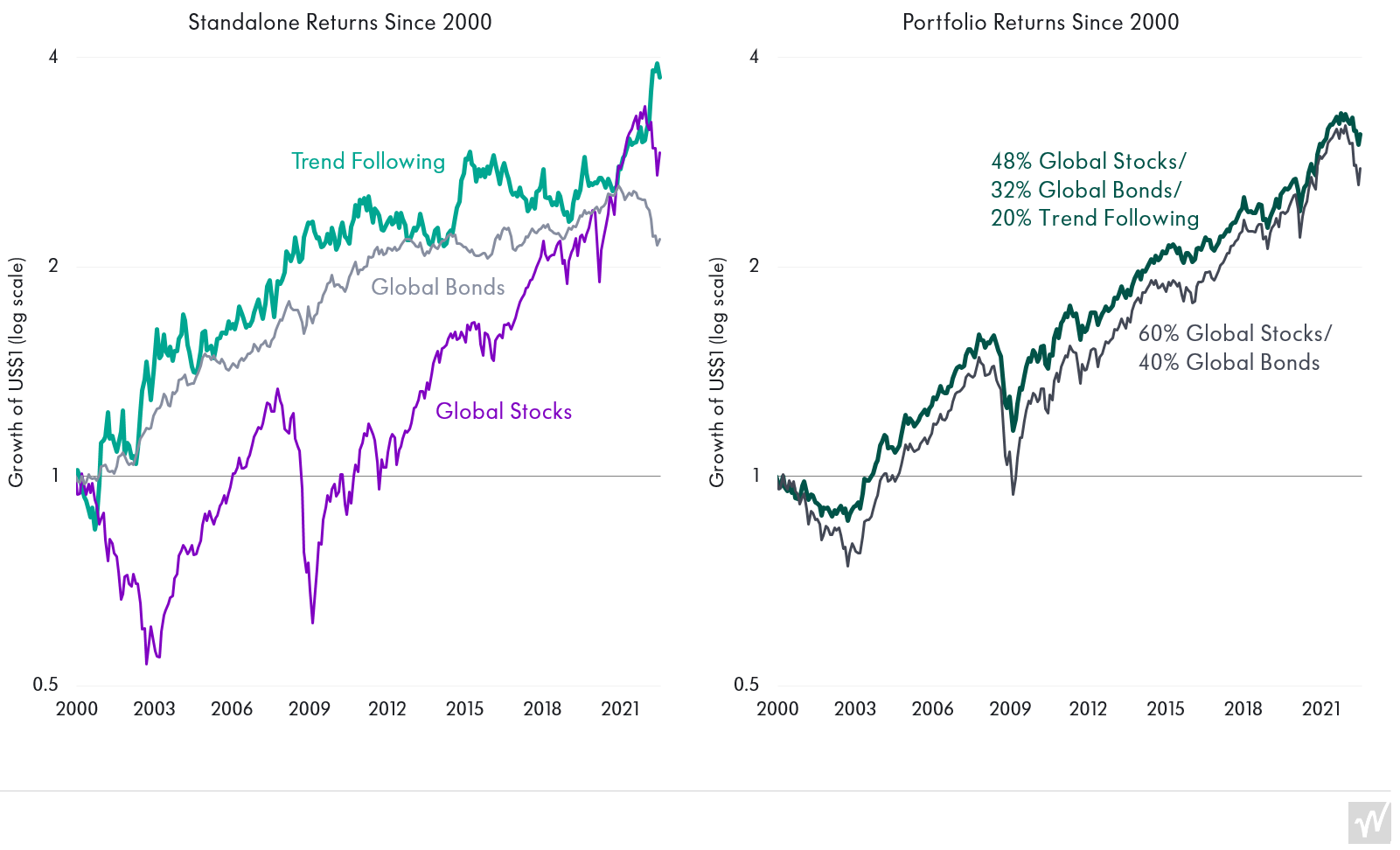

The analysis below shows how an allocation to the strategy since 2000 would have improved the returns of a typical stock and bond portfolio. This performance enhancement is driven by positive long-term returns and profits during difficult times for stocks and bonds, such as the 2007-2008 Global Financial Crisis, the 2000s Dotcom Bubble Burst and the first half of 2022.

Diversification and Potential for Enhanced Portfolio Returns

There are three key reasons why trend following is so complementary for stocks and bonds:

1. Long and short: Trend-following strategies take long positions in market uptrends and short positions in market downtrends. Traditional stock and bond investments are only able to profit from uptrends in their respective categories.

2. Novel exposures: Trend-following strategies provide exposure not only to global stock markets and bonds, but also currencies and commodities, spanning energies, base metals, precious metals, crops and livestock. There are few other ways UK investors can gain exposure to movements in the price of cocoa, live hogs and nickel in their investment portfolios.

3. Systematic: Trend-following strategies do not attempt to predict what markets will do next. Instead, they follow trading rules that dynamically adjust the portfolio in response to market price movements. This approach can prove especially valuable when markets behave in a way that forecasters and analysts fail to predict.

Choosing a Trend Following Fund

While the principles of trend following are straightforward, the successful implementation of the strategy is difficult. Experience and a commitment to research and development are critical, as is understanding the nuances associated with operating the strategy.

In this regard, Winton is well placed to help investors gain exposure to this style of investment strategy. The firm is a pioneer of systematic trend-following strategies and is a leader in the space, having navigated its portfolios through the various market environments of the past 25 years. Based in London, Winton is led by one of the most seasoned teams in the trend-following industry and employs 180 staff, most of which work in investment research and technology roles.

The firm’s trend-following strategies were made available in a standalone UCITS format for the first time in 2018 and have performed strongly since, making money during a challenging period for many investment strategies.