13 December 2018

Shining a light on currency black markets

Black markets conjure up images of shady characters in dark alleys with suitcases of dollars.

Although such activity exists, illegal currency transactions have often been conducted openly by otherwise law-abiding citizens. In Venezuela, where rampant inflation has left the national currency unable to hold its value, millions of consumers and businesses have been using black market US dollars to buy essentials. In situations such as these, black market rates often provide a more accurate reflection of a country’s economic circumstances than official exchange rates.

Because of its nature, data on the black market is hard to source. But Winton’s databases include unique records of monthly black market rates from 1947 to 1993 for around 100 currencies, from the Albanian Lek to the Zambian Kwacha, along with unofficial gold prices for a selection of global cities.

This data can be used to make observations about the nature of currency black markets. How do they arise and disappear? What form do they take? What determines black market premia for hard currency and how can such information be used by investors? Many economic studies are based on official rates that were fixed and chronically overvalued. By contrast, the parallel rates analysed by Winton provide a more nuanced narrative on postwar financial history, demonstrating the importance of consulting alternative sources of data that are extrinsic to markets when conducting financial research.

1. Foreign exchange restrictions spawn currency black markets

Black markets come about when controls on foreign exchange restrict access to the official markets, forcing people to resort to unofficial channels. This typically gives rise to a premium over the official rate known as the black market premium. Currency restrictions are primarily intended to prevent debilitating capital outflows during periods of macroeconomic weakness. They include banning the use and possession of foreign currencies within a country, banning residents from purchasing foreign securities or holding bank balances abroad, and restricting the amount of currency that can be imported and exported.

Another form of currency control involves the use of dual exchange rates. Governments sometimes introduce dual exchange rates during balance of payments crises to limit the short-term impact of capital outflows on domestic prices and international reserves. Priority current account transactions, such as industrial inputs, are assigned to the pegged official rate while all remaining legal transactions, including private capital account transactions, are supposed to proceed at an officially floating parallel exchange rate. Sometimes, countries use a complex array of multiple exchange rates in an attempt to resolve specific imbalances.

Sudan’s Multiple Exchange Rates

Although such arrangements are intended to reduce the pressure on the official rate, a black market may still exist along with dual or multiple exchange rates if insufficient currency is allocated to the official parallel exchange rate or if certain transactions, such as for narcotics, are excluded.

Under the Bretton Woods monetary order (1946-1971), most countries imposed controls since its system of fixed exchange rates and monetary independence could only be maintained at the expense of capital mobility. Consequently, most countries had black markets to some degree. Only a handful of countries were completely devoid of parallel markets, including, ironically, Venezuela – previously held to be a paragon of monetary virtue.

After the collapse of Bretton Woods in 1971, many countries still retained controls to navigate the financial chaos unleashed by the oil shocks, commodity price swings and the early 1980s recession and debt crises. This was particularly the case for developing nations in Africa and Latin America, but even developed economies continued to impose restrictions. Until 1979, British holidaymakers were not permitted to take more than £50 spending money out of the country and passports were marked with the amount of foreign exchange bought at the bank.

The US dollar had traditionally been the most desirable black market currency. When its link to gold was severed in 1971, as well as during the broader inflation of the 1970s, it lost some of its allure and other currencies such as the West German Mark and Swiss Franc, and gold, gained in popularity. The dollar’s desirability was also dented by the 1970 introduction of mandatory reporting by banks of all monetary transfers in and out of the US.

With the move towards economic liberalisation in the 1980s and 1990s, capital controls have been the exception rather than the rule and black markets have mostly withered away. But they still flourish in certain countries including Nigeria and Iran, as well as Venezuela. In Argentina, tourists can obtain “blue pesos” at illegal cuevas for twice the rate they can from ATMs.

2. The black market premium primarily reflects the severity of the restrictions

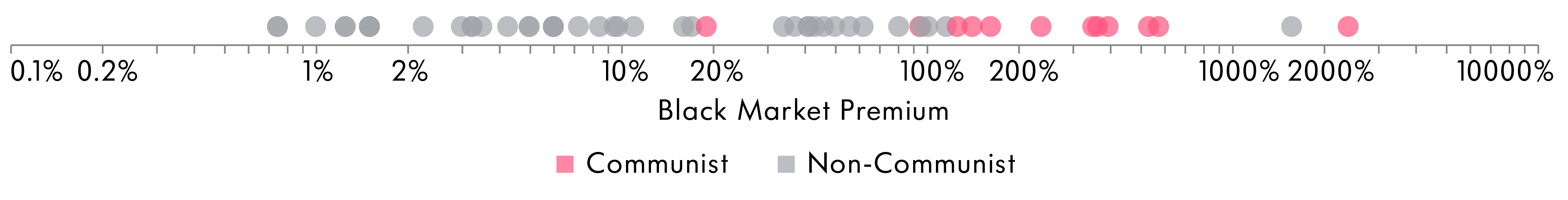

Black market premia over the five decades studied were typically below 100%, but they could rise far higher. China and the Soviet Union, along with their respective satellites, had premia in excess of 100%, with Poland’s routinely reaching 2400%. What set them apart from other economies was the stringency of their currency restrictions. Their monetary systems were designed to be hermetically sealed from the capitalist world and “crimes against the national currency” were punishable by death. The high premia reflected the risks and sheer difficulty of obtaining hard currency.

Communist vs Non-Communist Black Markets

Many factors determine the black market premium. On the demand side, anything that signals depreciation – for example, a deteriorating balance of payments – increases the demand for foreign currency. On the supply side, anything that affects the willingness of exporters, tourists and expatriates to divert FX from official to illegal channels is likely to affect the premium. But the key determinant is the severity of the FX controls. When the controls are strict, the stock of foreign assets is essentially fixed, such that any increase in demand will result in a steep rise in the premium.

3. Black markets can be more than simply backstreet operations

In the Soviet Union, despite the severe statutory punishments for currency crimes, black market transactions were carried out by practically everybody. By the late 1980s, services such as car repairs and plumbing, which would ordinarily take months, could be instantly arranged in exchange for payment in US dollars, Swiss Francs or West German Marks. Even dachas could be illicitly procured for $15,000 to $20,000. In urban areas, fully 45% of apartment repairs and 40% of car repairs involved the black market; and 80% of all services in rural areas involved hard currency payments.

There was official recognition of the black market as early as 1967. From that year, Foreign Exchange certificates were issued to the Soviet elite not at the official rate of 0.9 roubles per dollar, but at the black market rate of 4.6 roubles per dollar. The certificates were exchangeable for western luxuries in Moscow’s GUM store. A black market developed in the certificates themselves, which traded as high as 6-10 times their nominal value.

In Colombia, it had long been illegal to maintain FX accounts. During the 1970s, however, Colombia’s central bank opened a dedicated facility – the “sinister window” – where unlimited amounts of US dollars could be exchanged at prevailing black market rates. It allowed cocaine traffickers to launder their earnings while allowing the government to take a slice of their profits.

4. Premiums anticipate devaluations

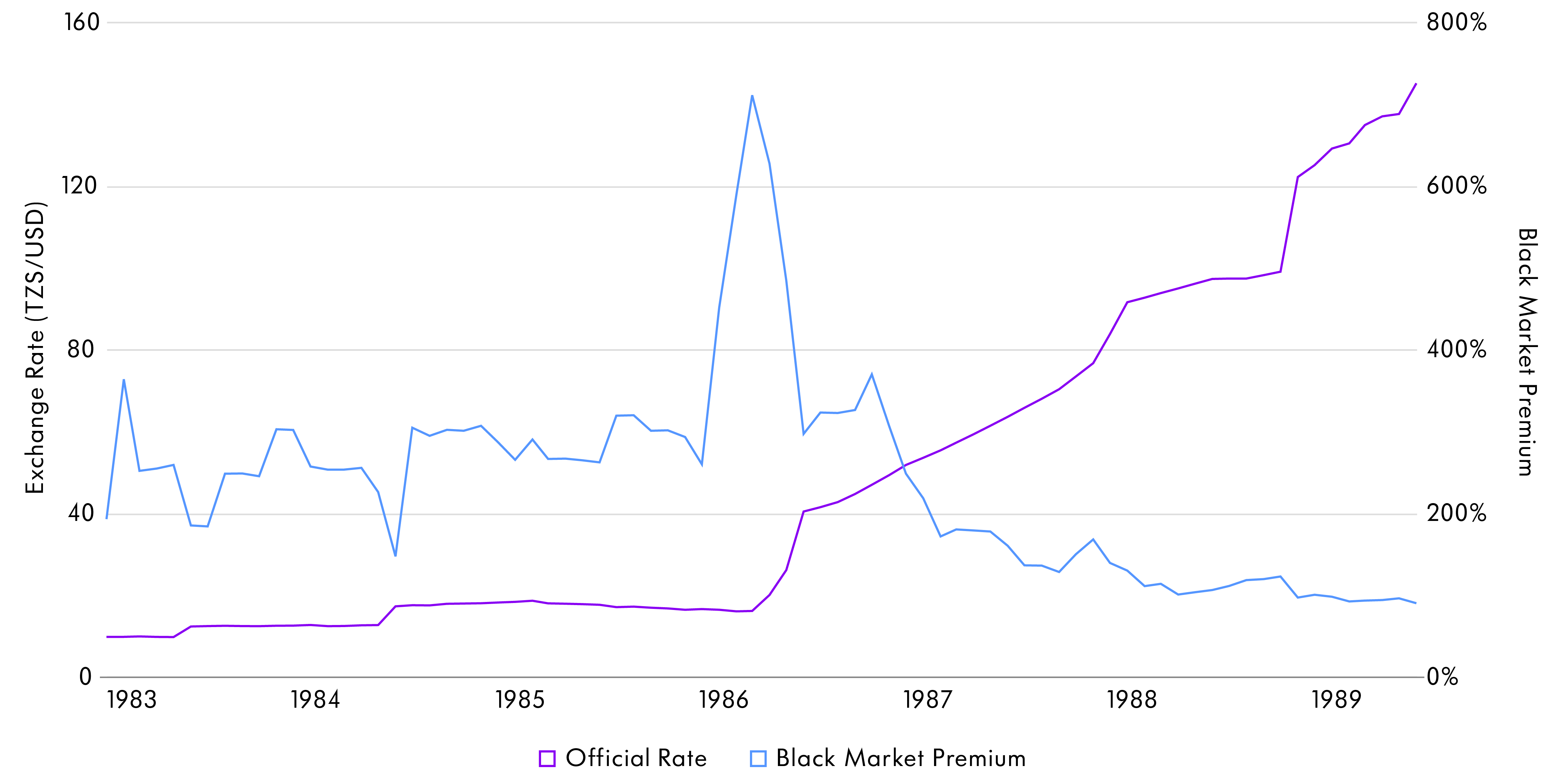

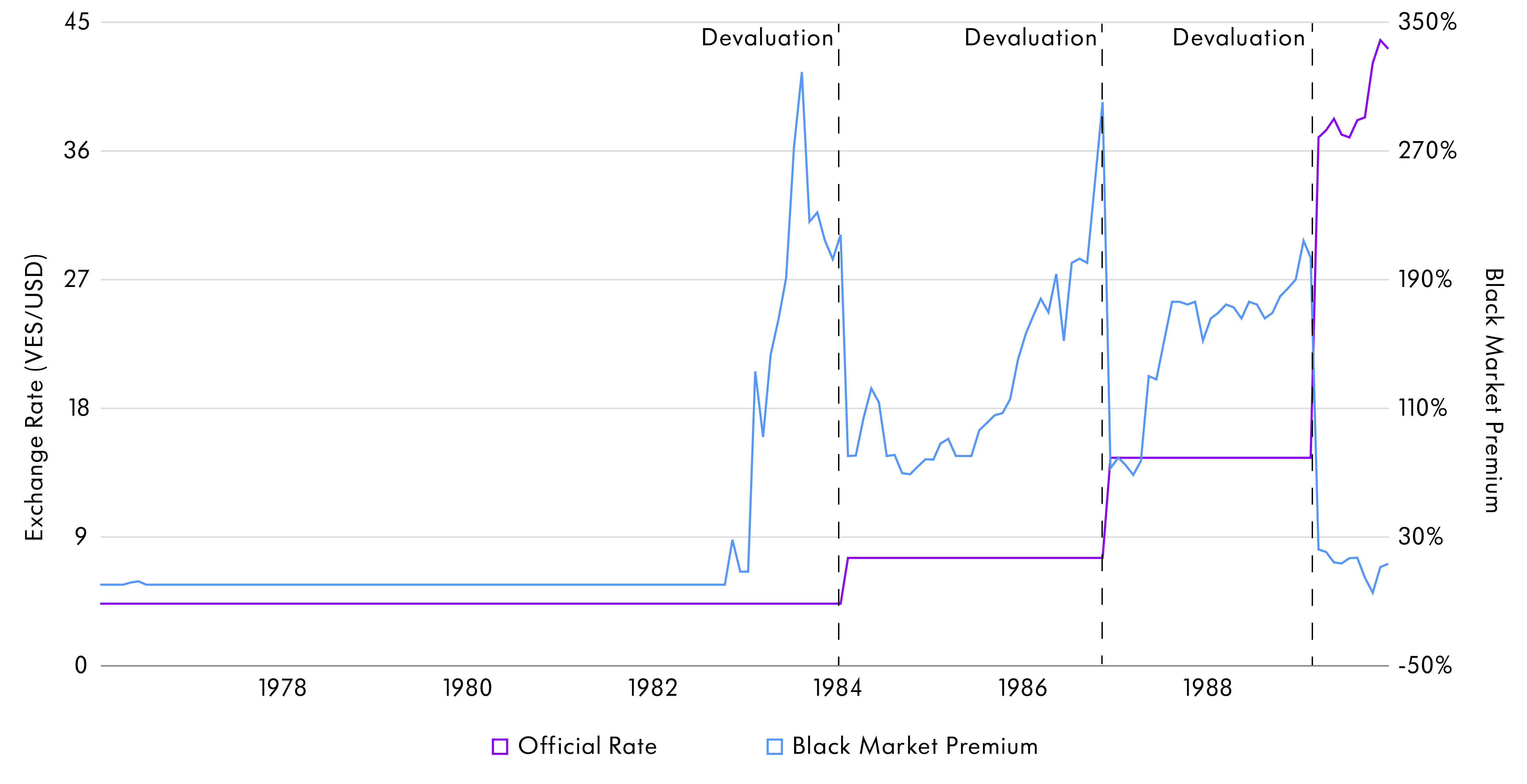

In Tanzania, the parallel premium surged in the run up to the 1986 devaluation to 800%. From 1984, it was clear to most people that a major agreement with the IMF would happen imminently and include a major devaluation. Capital flight ensued and the black market premium surged. When the devaluation occurred, the premium fell rapidly to reflect the new official rate. Sometimes, however, the causality has run the other way. It was the growing black market premium itself that prompted Venezuela to devalue three times during the 1980s.

Tanzania

Venezuela

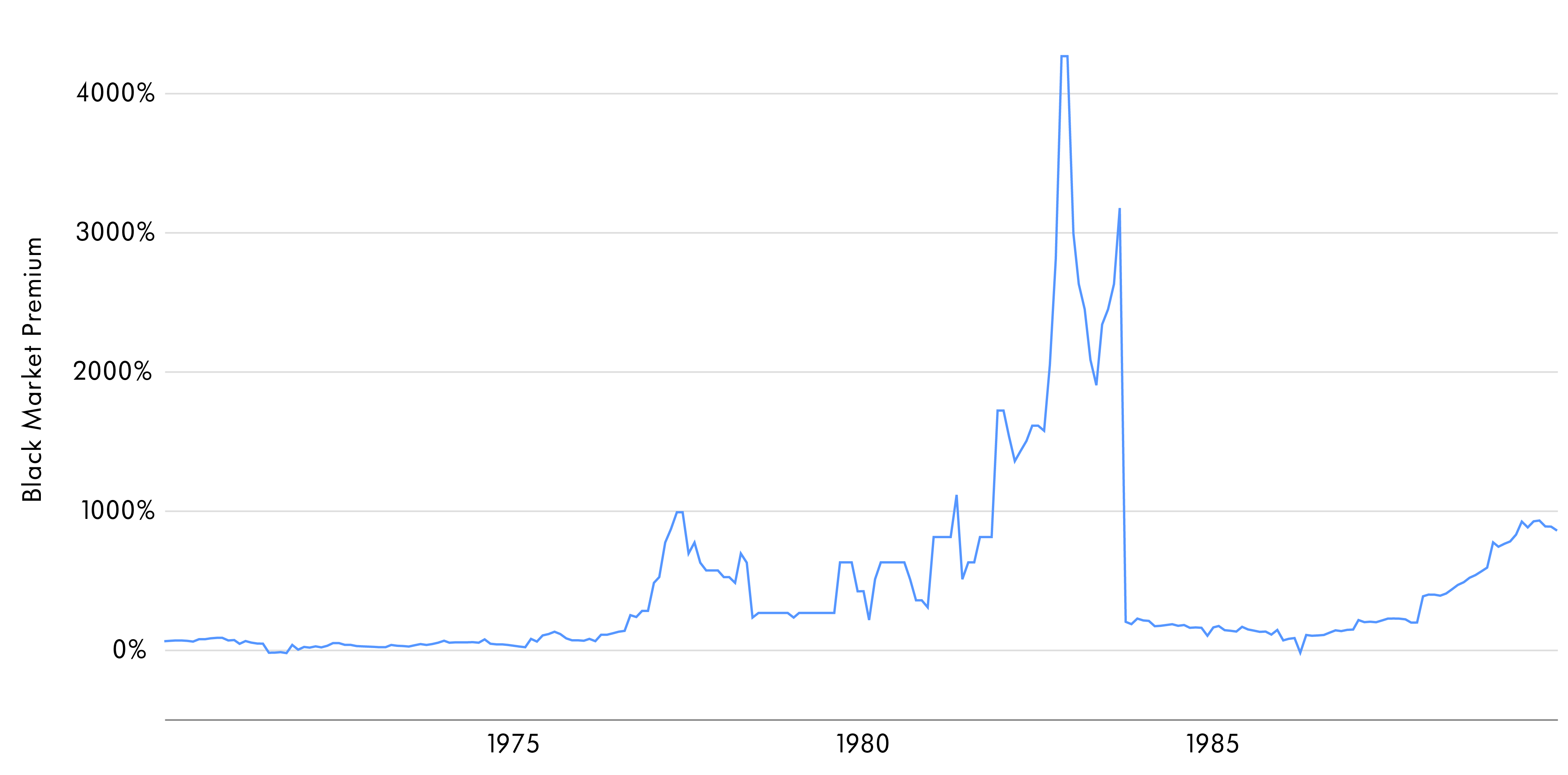

5. Large premia stimulate smuggling, import overinvoicing and currency arbitrage

Ghana’s exchange restrictions during the 1970s and early 1980s caused its black market premium to climb above 4000%. This resulted in export underinvoicing and smuggling on a massive scale. In terms of black market rates, producer prices for Ghanaian cocoa were much lower than those of neighbouring Togo and the Ivory Coast, creating a strong incentive for Ghanaian farmers to smuggle out their cocoa via those two countries rather than exporting at official rates. It is estimated that nearly half the country’s cocoa exports were smuggled out during the period. This had deleterious consequences given that taxes on the commodity’s trade were the government’s primary source of revenue.

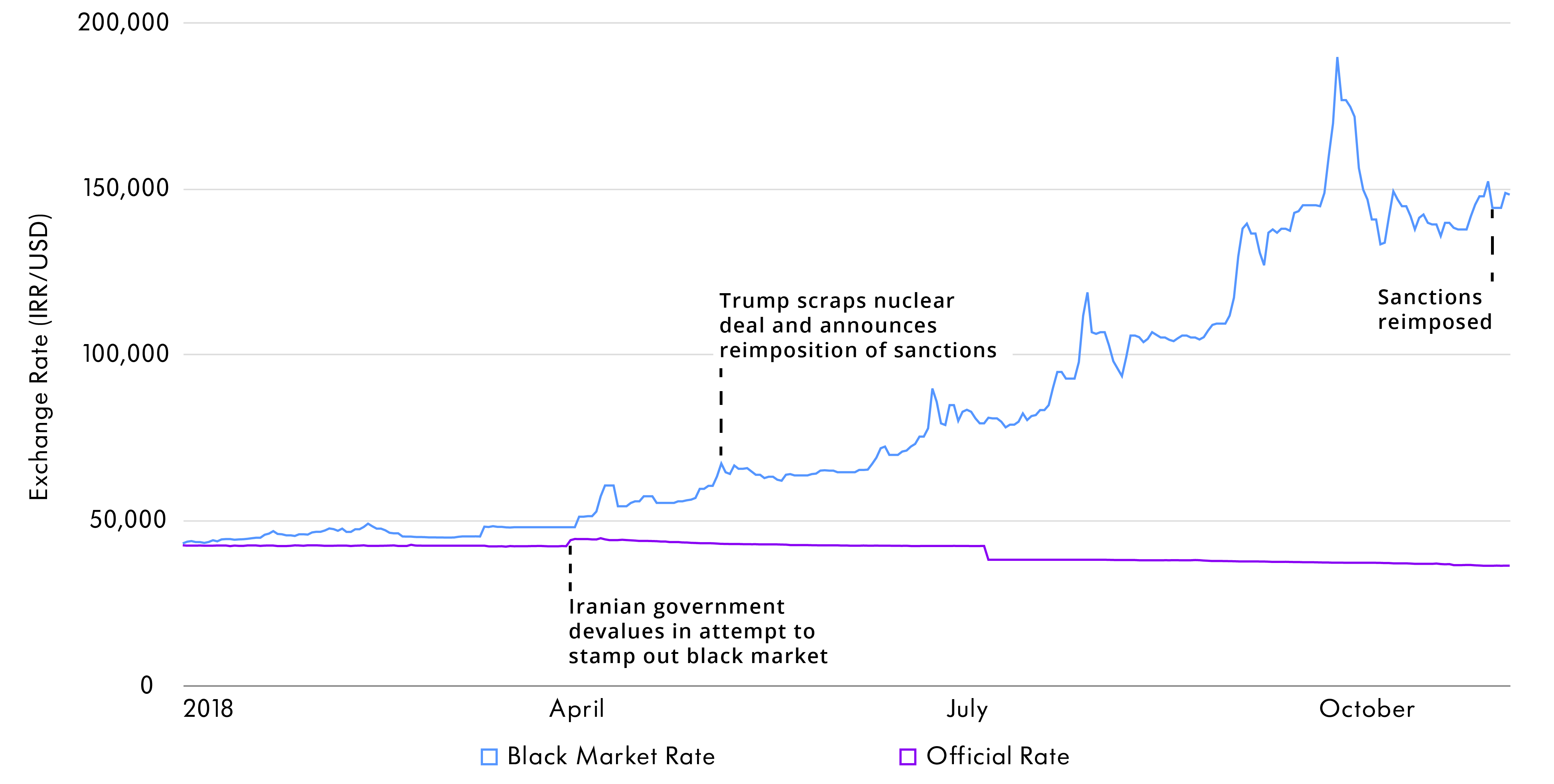

When Iran introduced a ‘preferential’ rate of 42,000 riyals per USD in April 2018, firms and individuals with links to the government imported goods at the official preferential rate, and sold them at the black market rate, profiting from the difference. This led to unusual purchasing practices. Textile companies imported sacks of beans, car manufacturers imported tea and coffee machines, poultry businesses imported iPhones. However, most importers were unable to access the preferential rate and were compelled to buy their wares at the black market rate, which raised their prices and pushed many out of business.

Large premia increase the incentives for the suppliers (for example, tourists, expatriates and exporters) and users (usually importers) of foreign currency to exchange at the black market rate, rather than the official rate. Exporters have often preferred to underinvoice their exports so that they can sell their excess earnings on the black market. Conversely, importers have often overinvoiced to secure more currency at the official rate, which can then be sold on the black market. These leakages can seriously undermine a country’s official trade.

6. Gold is also an important black market item

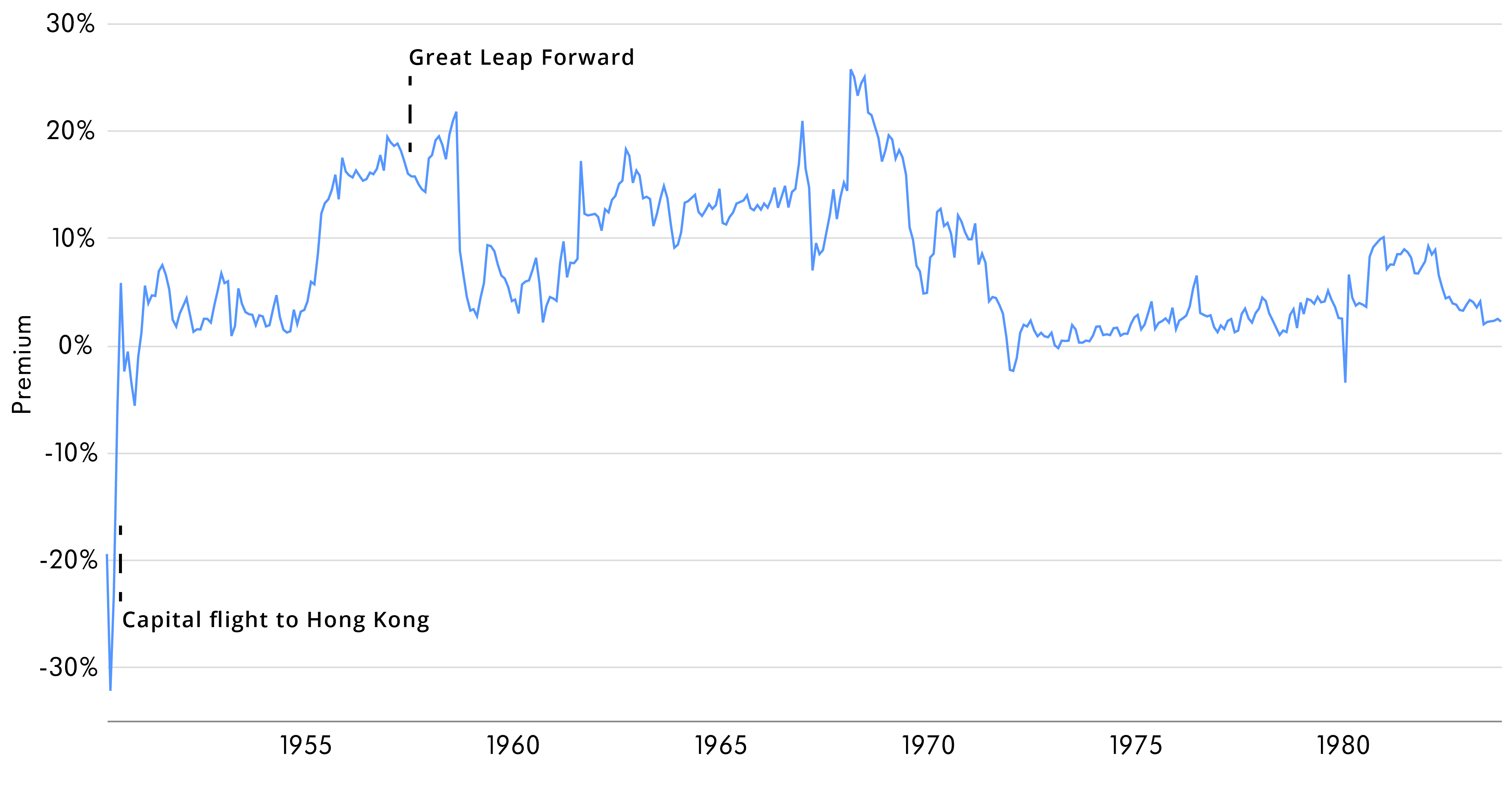

In China, until the 1990s, gold dealing and ownership was strictly prohibited, punishable by years of hard labour. Nevertheless, there was an active black market in gold throughout the country: Swiss gold made its way to the mainland via Hong Jong, Macao, Bangkok and Vientiane. Gold was also smuggled in by means of placing US double eagles coins in the coffins of Chinese Americans for burial in the homeland. Following the Communist Revolution, gold became a more important black market than even those in Hong Kong and US dollars. The black market premium for gold surged in times of drought and socio-economic upheaval, such as during the Collectivisation and the Great Leap Forward, yet settled down during the more sedate 1970s and 1980s.

Winton’s databases provides prices for gold bars, sheets and coins in more than 20 international cities. Since unrestricted gold trading was only allowed in a few places such as Hong Kong and Zurich, most gold markets were black markets in themselves. By studying the spreads between the restricted gold markets and the free markets, one can draw many of the same inferences that apply to the black market premium for dollars.

7. Black market rates are more reflective of a country’s economic circumstances than official rates

Black market rates are often more informative than official rates since they are forward-looking, sensitive to news, and more representative of how people view the prospects for their currencies. Fixed official rates by contrast typically change only due to necessity and have frequently borne little relation to a country’s actual economic circumstances.

Under Bretton Woods, governments were loath to devalue currencies even when they were vastly overvalued, since they regarded such a move as a national humiliation. And maintaining the fixed exchange rate has sometimes been a matter of political survival: Ghana’s 1971 devaluation led to rioting over increased prices, triggering a coup and discouraging successive administrations from attempting further, much-needed devaluations until 1982. Black market rates by contrast have no such compunction, swiftly reacting to balance of payments difficulties and inflationary episodes. And, as outlined above, they could be used to indicate the likely time and size of devaluations when governments were eventually forced to act.

Black market exchange rates can at times represent the best data available. Many socialist countries treated monetary statistics as state secrets, and official exchange rates were pie in the sky. In Pol Pot’s Cambodia no official exchange rate existed, for the currency had been abolished. The Soviet Union had a plethora of exchange rates including a “Punitive Rate for Trade with Capitalistic Entities”, but they signified little. They were purely notional since ordinary people could not convert currencies. In practice, the Soviet economy was largely based on moneyless transfers between state entities and barter deals with other Socialist nations.

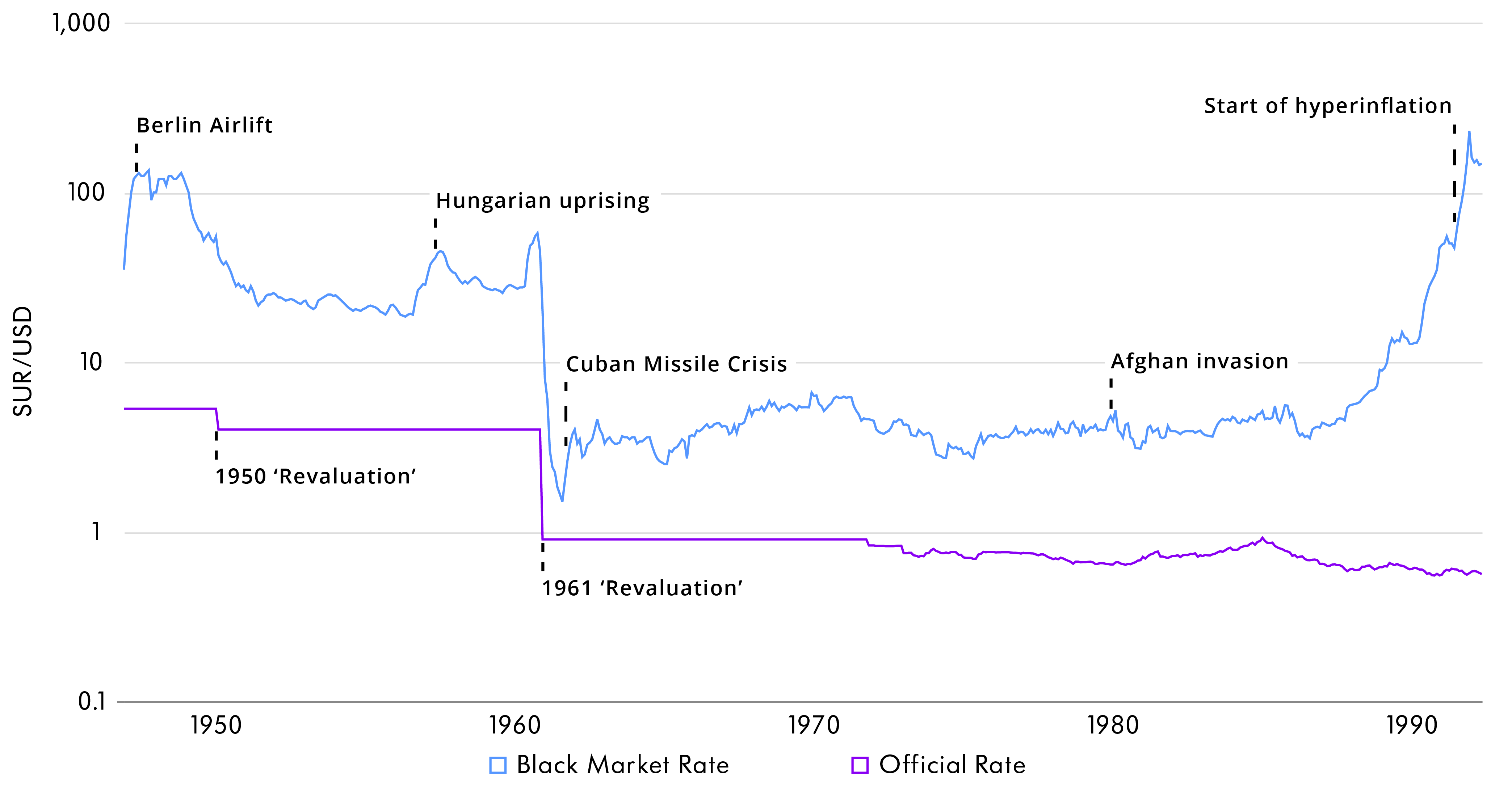

Despite a rouble revaluation in 1961, the black market rate painted a strikingly different picture. There is evidence of the impact of geopolitical crises such as the Hungary Uprising of 1956 and the Cuban missile crisis in 1962. The hyperinflation of the Soviet Union’s twilight years is also apparent.

By analysing the black-market rates contained in Winton’s databases, we have achieved a more holistic understanding of the economic conditions of the postwar period. We also gain a fascinating glimpse into the secretive economies behind the Iron Curtain – about which little has been written. Notwithstanding the general trend towards currency liberalisation in the past few decades, black markets still exist in economically significant countries such as Iran, Nigeria and India, and account for a sizeable share of their GDP. And as the experience of Venezuela shows, they can remerge in countries where they had previously been expunged.

As this 50-year dataset of black market rates shows, relying solely on official figures can blind investors to the truth. Yet alternative and unofficial data sources such as these can correct for this myopia, providing a richer perception of the underlying reality.