18 January 2017

Copper-bottomed booms and busts

Across the world, desperadoes were shinnying up pylons, breaking into substations and using quad bikes to rip up hundreds of metres of live copper cables from train tracks, seeking to make a killing down at the scrap yard but often killing themselves in the process. Their knavery led to delayed and cancelled train services and power outages affecting entire cities. What would possess a putatively sane person to cut through a 100,000V powerline? And to what extent was the 2000s boom unique?

Introduction

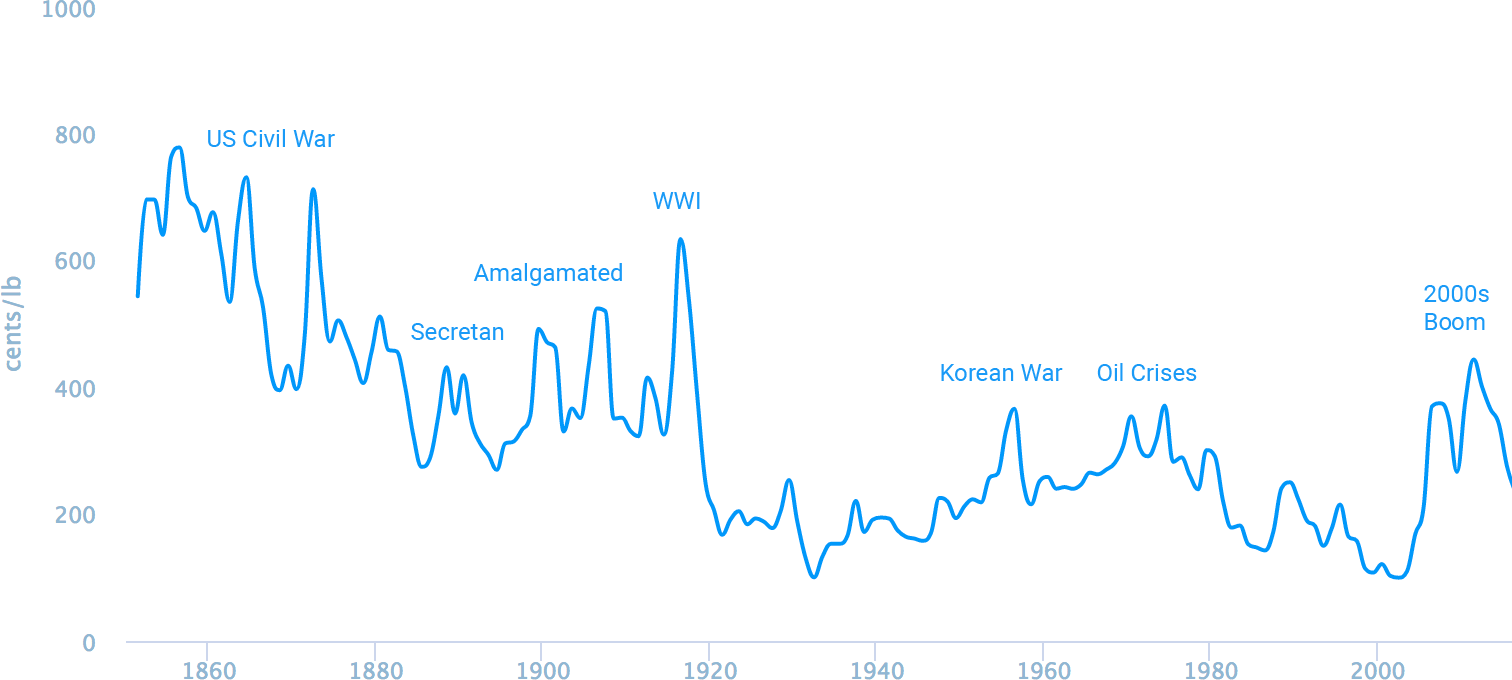

During the 2000s, the price of copper quadrupled, reflecting the extraordinary swell in demand by China. Urbanisation, rural electrification and growing car and appliance ownership resulted in burgeoning consumption. The typical eight-storey building uses around 20 tons of copper wire and pipes and China built thousands of such blocks during the 2000s. 1500 new cars, each containing 50lbs of copper, were hitting China’s roads each day. Millions of cell phones and PCs were sold in China, each containing ½oz and 1.5lbs of copper, respectively. Production struggled to keep up and inventories fell precipitously, triggering heavy speculative purchases. After touching 400c/lb in 2006, prices gyrated wildly before plummeting during the global slowdown in 2008. The market recovered within two years and when JP Morgan purchased over half of the LME’s warehoused copper in early 2011, spot prices hit a record 458c/lb.

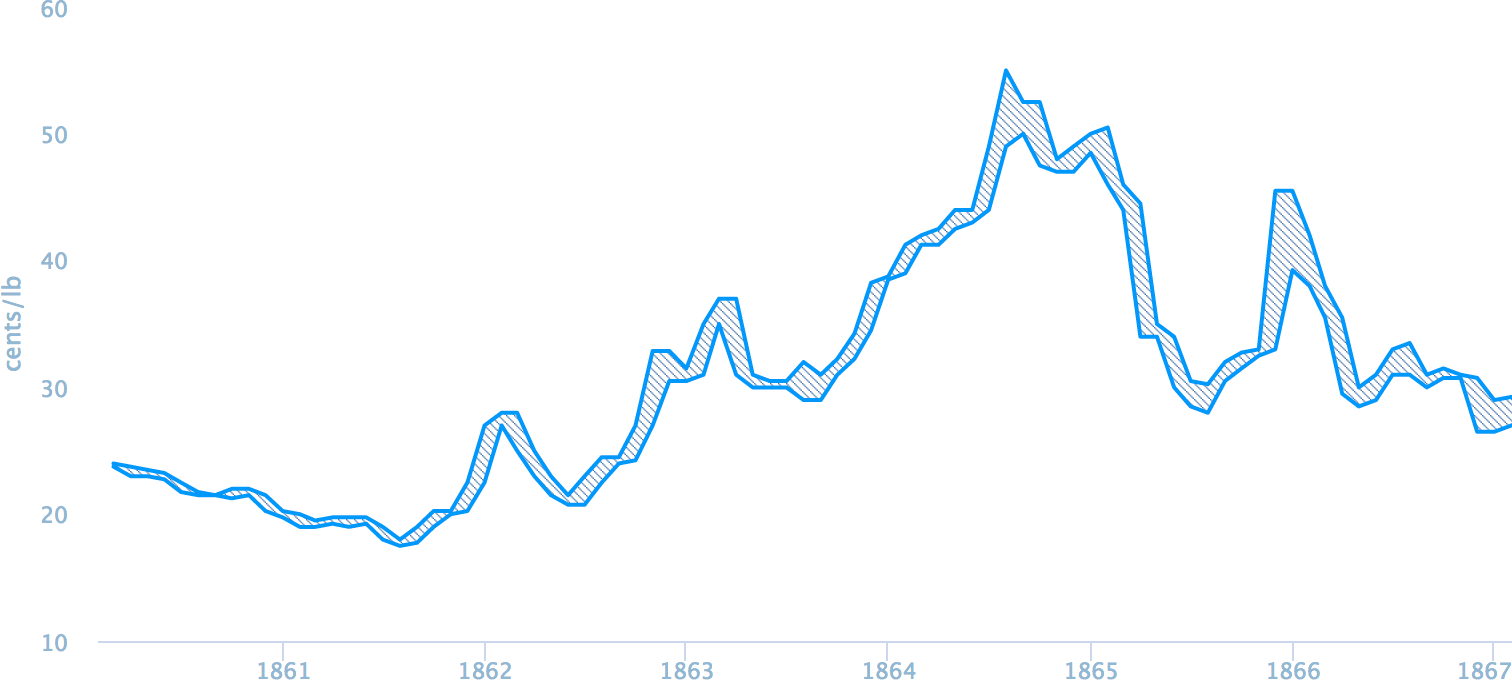

Whilst unprecedented in terms of its sheer scale, the 2000s copper boom was certainly not a one-off event. As Fig. 1 illustrates, there have been many such booms and busts throughout history. The rest of this feature sketches out the most salient price movements in the past two centuries and discusses possible future trends.

Real Copper Prices (1850-2016)

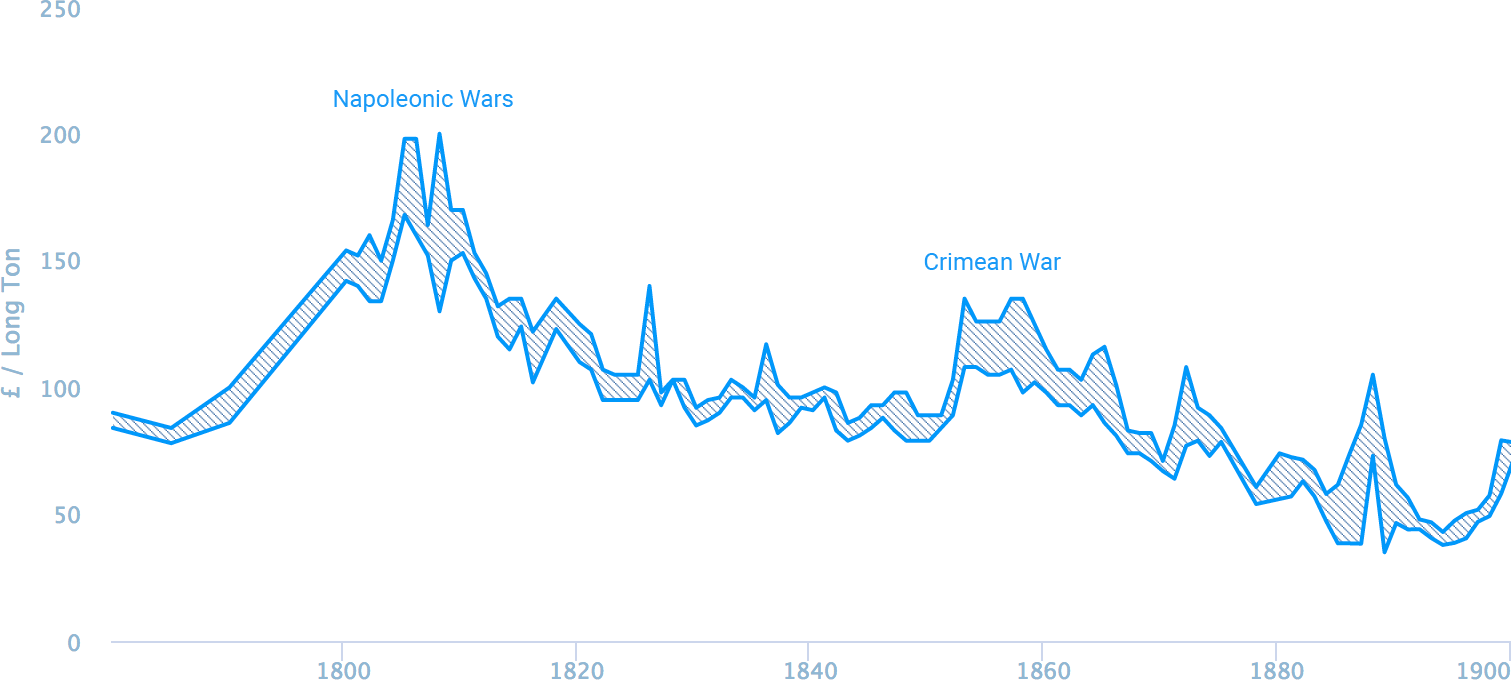

Copper-Sheathing Boom (1780s-1830s)

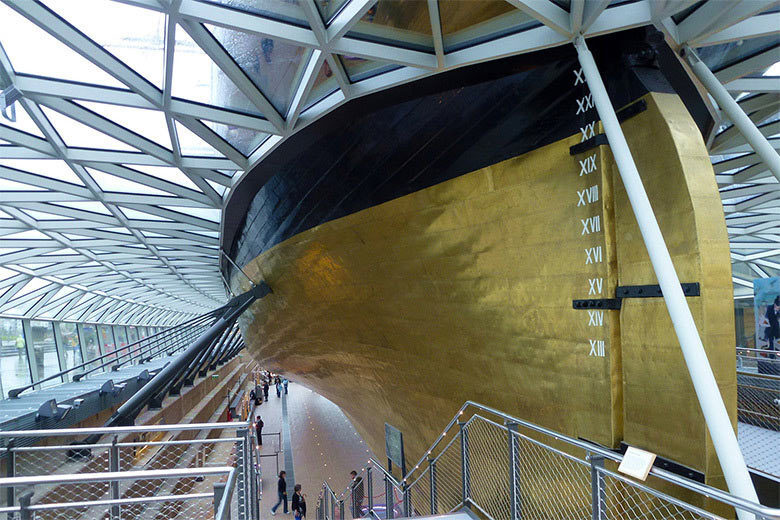

In the late 18th and early 19th centuries, the primary demand for copper was for sheathing the bottoms of boats, to protect against shipworm and seaweed. Copper-bottomed vessels were both faster and required less docking time than their untreated counterparts. The Royal Navy’s decision to re-hull their entire fleet in the 1780s gave Britain a strategic advantage during the Napoleonic Wars but also propelled copper prices from £78/ton in 1785 to £200/ton in 1807, since demand far outstripped the output of the mines in Cornwall and South Wales. This is the highest real price on record, equivalent to £20,470/ton in today’s money. However, the reign of high prices encouraged the development of overseas mining operations, notably in Chile, pushing prices back down to £85/ton by 1830. Pure copper sheathing was also being increasingly replaced with Muntz metal – an alloy containing 50% zinc and 50% copper.

Breaking Swansea’s Stranglehold (1840s-1860s)

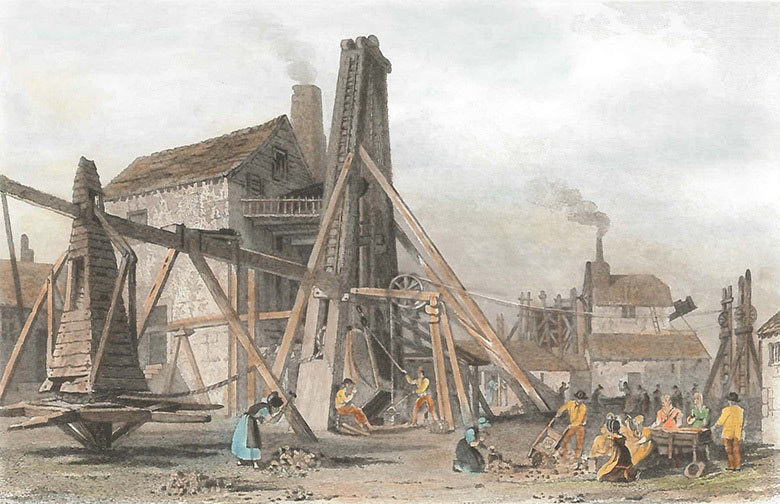

The explosive growth of the railways in Britain during the 1840s created a need for new source of copper for boiler plates, etc. Serendipitously, 400-ton boulders of native copper were discovered in upstate Michigan, heralding a vast increase in the world’s supply of copper ore. In view of the magnitude of the discovery, prices might have remained muted were it not for the actions of the Associated Smelters of Swansea – the world’s first copper producer cartel. During this period, Swansea’s smelters processed virtually all of the world’s ore, for they alone knew the secrets of the much-vaunted ‘Welsh Process’. This allowed them to dictate the prices at which they bought ore and to restrict their production to boost the prices of their finished products.

Prices began rising again in the 1850s, peaking at £135/ton in London at the height of the Crimean War. After a post-war slump, demand surged again with the outbreak of the US Civil War; the Union’s need for brass buttons, copper canteens and bronze cannons pushed Lake Superior Ingot from 17c/lb up to a whopping 55c/lb (see Fig. 5). High prices typically pave the way for lower prices by stimulating production, but on this occasion they often had the opposite effect by encouraging Michigan’s obstreperous miners to demand higher pay, get drunk and sit on their hands all day. One superintendent was forced to instil discipline by pelting his miners with rocks and scalding them with steam from the mill’s boilers! However, many mine owners sidestepped the problem by replacing their local workforces with foreign labour, notably from Cornwall, Wales and Scandinavia. Not only did they prove more sedulous, they also brought with them the secrets of Welsh process and established local smelting plants that broke Swansea’s stranglehold. Perhaps more significantly, the newly developed Bessemer process began to make a mark, vastly increasing the productive efficiency of the furnaces.

Lake Superior Ingot Prices (1860-1867)

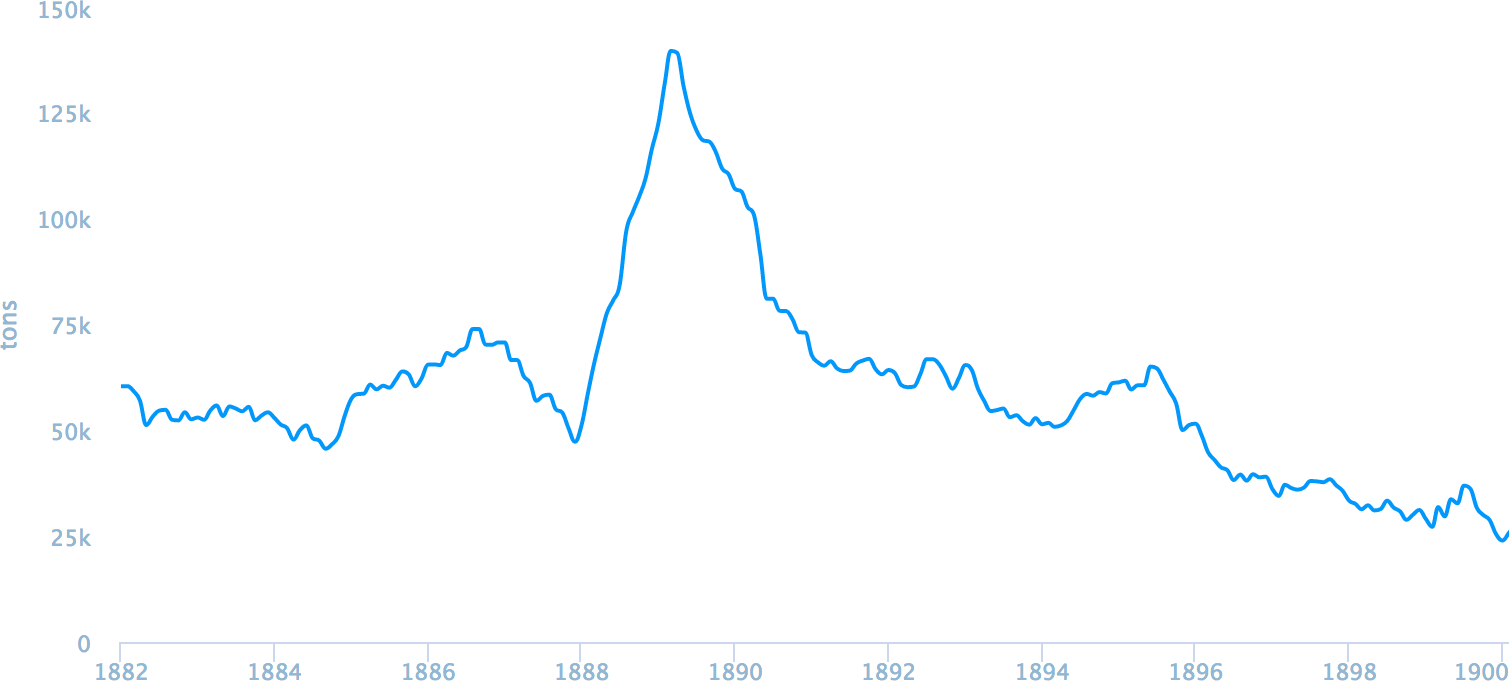

Secretan Corners the LME (1887-89)

There have been numerous attempts to corner copper, pushing its market price far above the level dictated by its fundamentals. The first and largest such attempt (by the standards of its time) was carried out by a Pierre Secretan, France’s largest brass manufacturer, between 1887 and 1889. By way of comparison, Secretan controlled over 80% of the world copper supply and singlehandedly pushed up prices by 150% whereas Yasuo Hamanaka (a.k.a. “Mr Copper”) who famously cornered copper in 1995, only ever controlled 5%.

A sustained fall in copper prices from 1882 encouraged consumers to run down their inventories, assuming they’d be able to purchase additional stocks even more cheaply in future. Meanwhile, despite the general surplus in copper production, the LME’s standard Chile bar contract had become under-supplied. Observing these two trends and anticipating that recent innovations such as the light bulb, trolley car and telegraph would create an insatiable demand for copper, Secretan sought to corner the metal.

Backed by a syndicate of 13 French banks such as Rothschild de Paris and Comptoir d’escompte, Secretan started buying LME Chile bars in autumn 1887, when prices were around £40/ton. Simultaneously, he gained control of the production of 80% of world’s mines by offering them an attractive fixed price of £68/ton over a period of three years on condition that they didn’t increase their output. With the LME cornered and virtually all new production accounted for he could now sit back and watch his profits roll in. By January 1888, LME Chile bars had shot up to £85/ton, inflating the price of other copper contracts as anxious consumers sought to replenish their inadequate stocks.

But he had miscalculated. Primary producers began releasing their retained stocks on the inflated market and secondary (i.e. recycled) production surged. Battered pots, pans and cracked bronze bells were transformed into ingot, making down-at-the-heels scrap collectors as rich as Croesus. Secretan could not hold back the tide and by February 1889, was carrying 180,000 tons (nine months of world production) at great expense - he had already exhausted the then fabulous sum of £6m. It was a losing proposition. On 5 March, the secretary of Comptoir, saw the writing on the wall and blew his brains out. LME Copper fell from £100/ton to £35/ton overnight when the news broke.

The collapse threatened a major panic in France as the syndicate’s loans had been based on the market value of copper which was entirely artificial. Only the intervention of Bank of France averted disaster. Keen to be done with matter, France’s bankers began dumping the syndicate’s enormous backlog onto the market. With electricity demand still growing slowly, it would take a year just to absorb this amount without any new production. Mine owners were naturally aghast and launched a counterattack in which they threatened to start selling at £20/ton. Not prepared to sacrifice copper that had been purchased for £68/ton on a £20/ton market, the syndicate’s liquidators agreed to sell their backlog gradually over four years. Copper remained depressed for the next six years and hung around £36/ton until the backlog was absorbed and electricity demands had caught up.

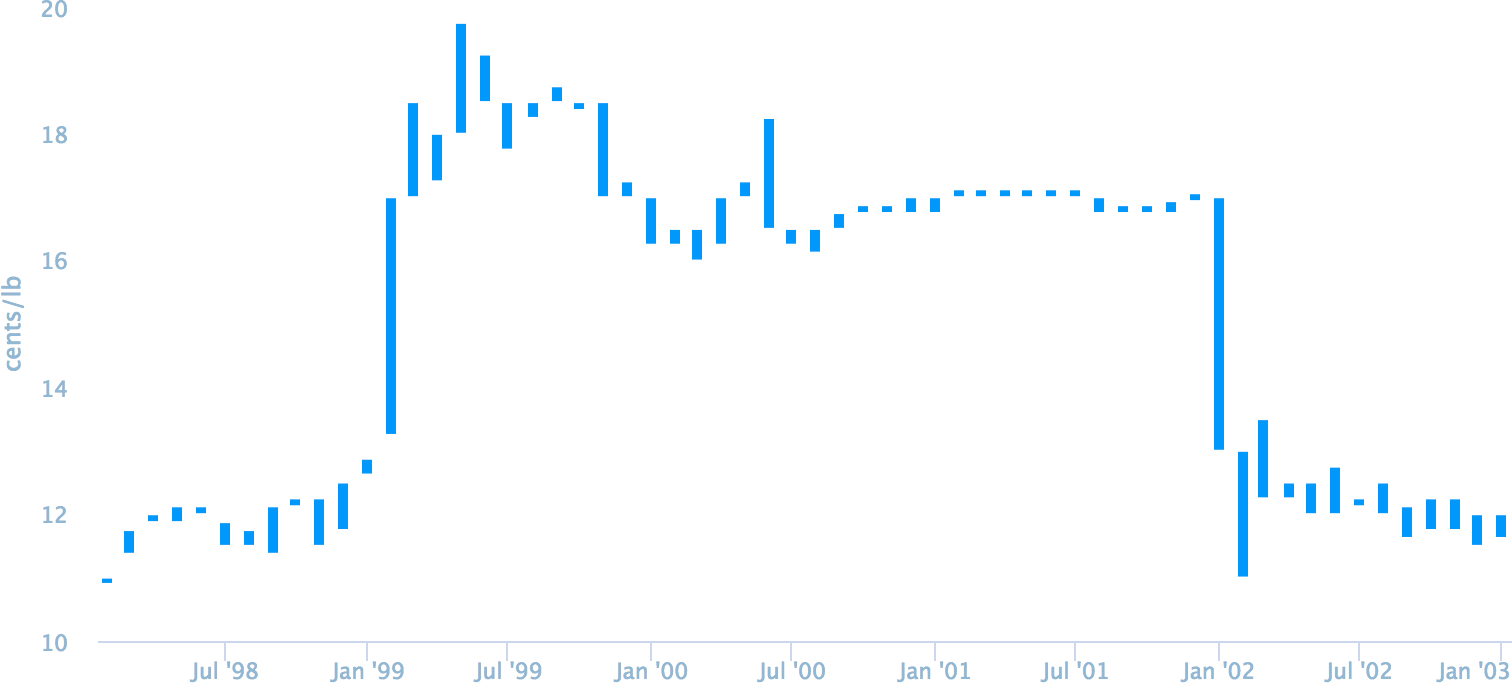

Amalgamated’s Flip-Flop (1899-1902)

It took precisely 10 years for the lessons of the Secretan debacle to be forgotten. In April 1899, Standard Oil resolved to monopolise the world’s copper market as it had previously done with oil and duly established the Amalgamated Copper Company. Among other interests, Amalgamated held a controlling stake in Anaconda – the world’s largest copper producer which was based in Butte, Montana. Initially, with the cooperation of other large producers, Amalgamated curtailed its production and exports to Europe, sending prices soaring. Yet the high prices merely stimulated increased production by independent producers, which Amalgamated had to buy up at great expense.

Eventually, Amalgamated changed tack and contrived to beat down the price of copper until independent producers could no longer break even and would be willing to sell out. In October 1901, Amalgamated began selling below the market, driving the price down to 10.5c/lb, and when they ran out of ingot, began selling unmined copper. However, the independents held out, declaring they would not sell until the market improved. Amalgamated found no satisfaction in having to supply the world at its own cutthroat prices and within a few months hiked the price back up to 15c/lb. At that point, the independents dumped their backlog on the market which quickly absorbed it thanks to the rapid growth of electricity.

Lake Superior Ingot Prices (1898-1902)

The Lights Go Out All Over Europe (1914-1921)

The Great War, a cause of untold suffering for millions, was a veritable boon for the copper industry. The war machine required obscene quantities of the red metal for shell cartridges, bullets and gun parts, leading to windfall profits for copper miners. Whilst Europe’s gentry were swapping their tops and tails for muddy fatigues, Michigan’s grubby miners took to wearing silk shirts with their new found riches.

After an initial slump, London copper prices began their upward trajectory as the war economy locked into gear. The British government was initially content to rely on the workings of the market to deliver copper for war contracts but nevertheless commandeered supplies destined for the Central Powers and strong-armed America into supplying its entire surplus production. Every little helps. There was a brief break during the summer of 1915 as speculative purchasers took fright at the prospect of dearer money and government control of the LME but prices then continued their upward march.

In May 1916, the British government poured cold water on the bulls at LME by banning speculation in base metals, but the market regained its balance in July, fuelled by the material needs of the Battle of the Somme. The rally continued until December when the UK government, through the agency of the Ministry of Munitions, essentially took over the LME, fixing prices and requisitioning the LME’s stocks for the war effort. Thereafter the government sold directly to consumers (mostly munitions factories) and the LME’s quotations merely reflected the official prices in war contracts. In September 1917, the US government followed suit and fixed prices at 23.5c/lb.

Government control in both countries remained in place until the November 1918 Armistice, whereupon New York and London prices dropped like a stone. Supply suddenly far outstripped demand. Four years of war had encouraged the warring nations to develop new sources overseas (e.g. Rhodesia) and innovations such as the froth floatation process and open-cast mining allowed the exploitation of lower-grade porphyry ores. Moreover, the secondary market was saturated - millions of pounds of scrap metal on the battlefields were collected and melted down. Pent-up demand led to a brief resurgence during 1919-20 but the market then slumped again.

WWII & Korean War Boom (1939-56)

Unlike WWI, price controls were imposed from the outset of WWII and LME copper dealings did not resume until August 1953. The British government was keen to avoid the market volatility and profiteering that characterised the early days of the Great War and opted to manage the nation’s copper supply and demand itself. LME’s Standard price was fixed at £56/ton for the duration of the war and purchases were prohibited except under government license. The official price was hiked several times at the cessation of hostilities, reflecting the post-war reconstruction and automobile booms and the 1949 sterling devaluation.

The outbreak of the Korean War in 1950 further strengthened demand as governments across the world commenced strategic stockpiling programs. In January 1951, the US government imposed a ceiling price of 24.6c/lb on domestic copper which remained in place until the end of 1952. Price controls held US domestic prices lower than world prices, creating shortages. Even after the release of these controls, US producer prices typically remained lower than world prices as producers sought to prevent the substitution of copper wiring with cheaper materials such as aluminium. This two-tier market - producer prices for US consumers and LME prices for everyone else - characterised the next two decades. At times there were wide divergences; during the late 1960s, the producer price was 30c/lb whilst world prices nudged 50c/lb.

The Turbulent 70s (1970-1980)

Following the collapse of the Korean War Boom, the copper market recovered quickly. Worldwide consumption grew apace during the 1960s, driven in large measure by Japan’s economic miracle and US stockpiling for its war in Vietnam. The combination of the 1971 Nixon Shock, the 1973-74 oil embargo, and the release of US price controls served to push prices even higher, peaking at £1400/ton in April 1974. CIPEC, a cartel comprising the world’s four primary exporters, sought to arrest the subsequent downturn by curtailing production and abandoning LME pricing but lacked effect due to quota cheating. But where CIPEC failed, inflation and the second oil crisis succeeded, ratcheting prices to a heady £1590/ton in 1979.

Thereafter, prices generally declined during the 1980s and 1990s, albeit with a couple of large rallies in 1988 and 1995. In the early 1980s, recession and high interest rates depressed all commodity prices, drawing money from commodities into bonds and discouraging capital expenditure and stockholding. Novel technologies also served to reduce the production costs of copper such as heap leaching, electro-winning and flash smelting. The divestiture of copper companies by oil majors resulted in more efficient independent operations, embracing these new technologies. Extensive miniaturisation and substitution also took their toll on copper demand.

The Shape of Things to Come (2017 - )

Copper prices have recently surged, partly due to the anticipated demands of President Trump’s infrastructure plans and the prospect of faster economic growth in the US. It remains to be seen whether these expectations are borne out by reality but the bull case has recently been gaining prominence. China, which already accounts for over 50% of world consumption, is currently developing a number of megacities and high-speed rail networks which will require large amounts of copper. These include the Pearl River Delta project, due to be completed by 2030, which will form one city out of nine with a population of 57 million. The increasing role of renewable energy will also boost consumption since wind turbines and solar panels require larger amounts of copper, per unit of energy generated, than traditional coal and gas plants. Likewise, electric and hybrid cars use more copper than regular gasoline vehicles - 165lbs, 110lbs and 55lbs respectively.

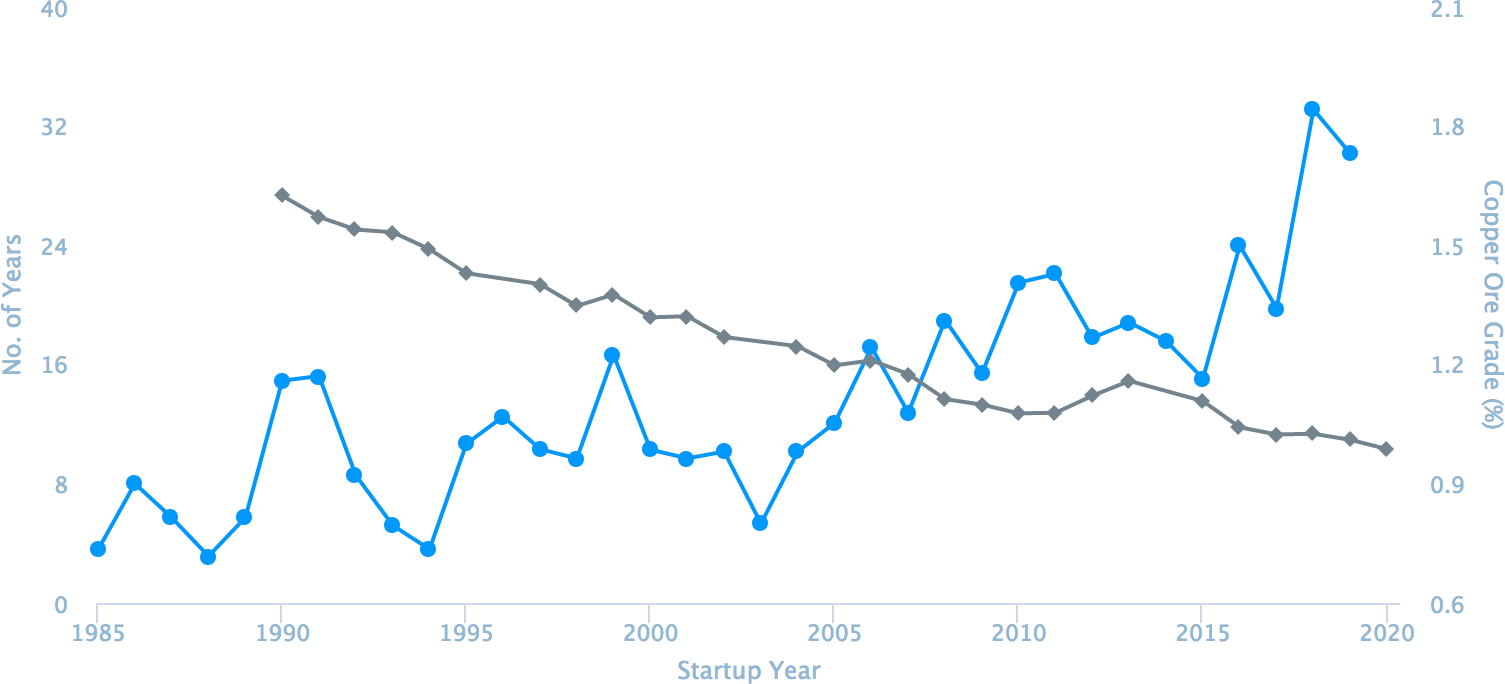

On the supply side, the marginal costs of mining are likely to continue to rise. Grade ore concentrations are in secular decline whilst mine development times are ever increasing (see Fig 15). Scaling up copper production will also encounter resistance from environmental groups as open-cast mining and smelting are both highly polluting activities. Open-cast mining is an eyesore and releases sulfuric acid and heavy metals into local water systems whilst smelting liberates large volumes of sulphur dioxide. With the depletion of low-cost deposits in developed countries, production and refining is increasingly shifting to more volatile and physically inhospitable locales such as DR Congo and Afghanistan. China is attempting mitigate the risks of operating in these environments by buying and running the mines itself and offering inducements to the host governments. Recently, it even secured the Taliban’s agreement to protect its $3bn Mes Aynak project, north of Kabul. Nevertheless, the potential for unanticipated disruptions remains, in which event China would be forced to meet its needs on world markets at short notice.

The Perpetual Nature of Boom and Bust

The prospect of rising demand coupled with a finite supply of copper ore, seems to support the ‘Peak Copper’ prediction of permanently increasing prices. But as we have seen, prices have always been highly cyclical and there is no reason to suppose that this won’t continue to be the case.

The first reason for this cyclicality is that copper demand is linked to cycles in business activity and credit growth. Economic booms have typically boosted consumption whilst recessions have had the opposite effect. Given the metal’s importance throughout the economy, copper prices have frequently served as an economic bellwether and presaged turning points in the stock market. For this reason, copper is sometimes referred to as Dr Copper and there is an old adage, “Every bull market has a copper roof”.

The second and perhaps more important reason is the reflexive nature of supply and demand. High prices have historically paved the way for lower future prices by stimulating the discovery of new sources and technologies that reduce processing costs such as froth flotation, flash smelting, electro-winning and heap leaching. Higher prices also mute demand through increased substitution, as we saw with the use of aluminium wires in the 1970s and miniaturisation in the early 1980s. Conversely, low prices dampen production and encourage profligate consumption.

Theoretically, producers ought to be able to stabilise prices by keeping their output in line with demand. In practice, this has rarely happened. Not only is it notoriously difficult to forecast consumption, increasing production takes time. New mines can now take upwards of 30 years to develop, making it nigh on impossible to coordinate additional output with periods of heightened demand. Moreover, low prices discourage mining investments even though, given the inevitable lead time, there may be a rational case for expanding capacity.

There have been many attempts to manipulate the copper market through cartels and corners, many of which have strongly influenced short-term prices but had little long-term effect. There are too many potential sources of copper to exercise total control over the world’s primary and secondary production. And as numerous producers cartels have learnt, the attractions of high prices have usually undermined the discipline needed to control the market in the long-term.

Ultimately, market forces cannot be repressed, except by governments in times of national emergency such as WWI and WWII. So long as we do not find ourselves in a state of all-out war, there will continue to be investment opportunities in the copper market.