12 October 2017

Ed Thorp, Claude Shannon and the world's first wearable computer

Thorp, 85, is a former American mathematics professor and hedge fund manager, who became a New York Times bestselling author in 1962 with his first book, Beat the Dealer. The book contained mathematical proof that you could do the seemingly impossible: beat the house at blackjack by counting cards.

Thorp’s focus on blackjack was, however, a by-product of a separate casino-related obsession: roulette. Thorp had first envisioned a technique for predicting roulette outcomes as a physics undergraduate. His conjecture was that an orbiting roulette ball could be “like a planet in its stately, precise and predictable path”.

And so it proved. It surely helped that Thorp gained a prominent partner on the project, the so-called “Father of Information Theory” and arch gadgeteer, Claude Shannon.

From Analog to Digital

By the time the pair joined forces in 1960, the two papers that had made Shannon’s name had long been published. The first was Shannon’s astoundingly influential master’s thesis in 1937, which proved, as biographers Jimmy Soni and Rob Goodman recount in A Mind at Play: How Claude Shannon Invented the Information Age, that binary circuits could perform logic.

Shannon’s second major intuition came to him during his employment at Bell Labs, the American telecoms research centre that was a font of technological innovation throughout much of the 20th century.

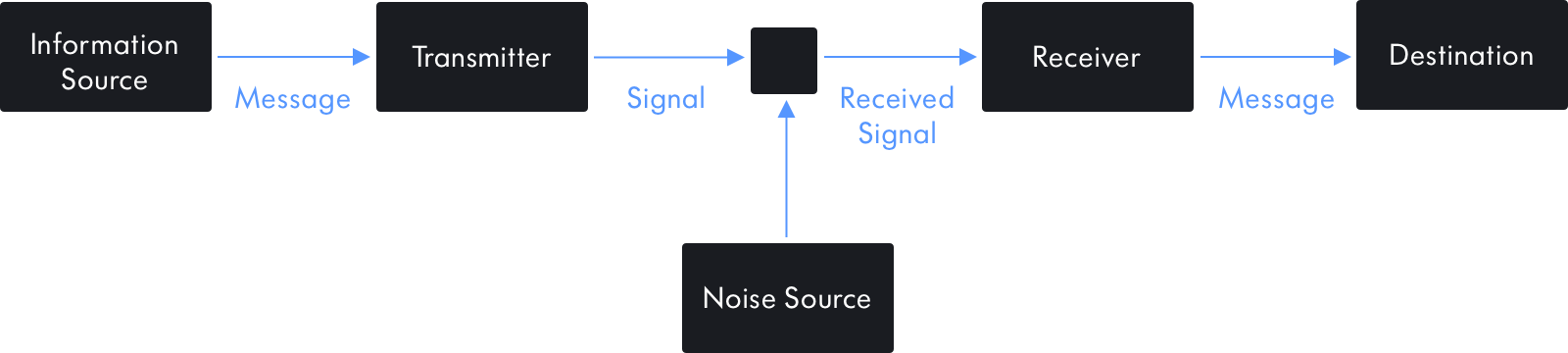

In A Mathematical Theory of Communication, a paper published in 1948 in the Bell System Technical Journal, Shannon proved that the process of transmitting all information – be it from telegraphs, radio, television, telephony, and so on - could be described in the same manner.

Shannon built his theory partly by splicing together the observations of two earlier academics: Ralph Hartley, who showed that there is only meaning in what we send each other if there is prior agreement about the symbols involved; and Harry Nyquist, who saw that electrical messages contained patterns, thus introducing the concepts of bandwidths and frequencies.

Still, Shannon’s breakthrough came from adding two ideas that information science had missed. On the one hand, Shannon grasped the probabilistic nature of information transmission. On the other, he understood that the concept of redundancy was crucial – in other words, interpreting a message one has received is effectively a process of eliminating the information that was in fact left out. Shannon’s paper introduced the idea of the binary digit, although the world is fortunate that this was shortened neatly to “bit” rather than any of the ugly alternatives dreamt up by Shannon’s Bell Labs colleagues, which, according to Soni and Goodman, included “binit” and “bigit”.

Shannon later retreated to a quiet professorship at MIT and many years of happy gadgeteering. Among the new and wonderful contraptions that Shannon created were Theseus, a maze-solving mechanical mouse, and a trumpet that spouted fire when played.

But arguably the most notable was Shannon and Thorp’s collaboration, which MIT has declared the first wearable device – one that was used to transmit information about roulette wheels. The final version they used consisted of a cigarette packet-sized box that could be placed in a shoe, and that could transmit an audible signal to an earpiece used by another person. Usually, Thorp would write down numbers randomly at the wheel without even looking at the spinning ball, while Shannon observed its trajectory and sent the appropriate betting information to Thorp.

Their study of roulette wheels had given them what they calculated was an expected gain of 44%. Yet their caution in placing big bets and their fear of a potential shakedown from the casino operators prevented them from profiting to any great extent from their advantage.

“The Biggest Casino in the World”

Nonetheless, Thorp’s growing wealth from beating the casinos at their own games prompted him to turn to financial markets to invest his winnings. He learnt from some early and common mistakes, which included over-leveraging and falling prey to psychological bias. But he soon discovered the options pricing formula that would be later be published by academics Fisher Black, Robert Merton and Myron Scholes, and whose names it bears. Ultimately, Thorp’s Princeton Newport Partners, the first market neutral hedge fund, recorded 19 years of gains with just three months of losses.

Shannon himself was no slouch at financial market investment either. As Thorp recalled: “One day I walked into his study to find a cryptic 2^11=2048 on the blackboard. He had been buying hot IPOs in a raging up-market and doubling his money monthly. He also had been profiting greatly from insightful early stock purchases in local high tech companies.”