Responsible investment policy

October 2025

Purpose and scope

Winton Capital Management Limited (“Winton” or the “Firm”) is a quantitative investment management company, founded in 1997 by Sir David Harding and headquartered in London. This Responsible Investment Policy, which complements the Corporate Social Responsibility Policy, explains Winton’s commitment to responsible investment and the application of the policy to its business and investment strategies. The Policy is maintained by Winton’s ESG Committee, which is chaired by the Firm’s Chief Operating Officer and is responsible for coordinating its responsible investment, corporate social responsibility and diversity and inclusion efforts.

Industry engagement

Winton has a history of engaging with other industry participants to improve practices and promote high standards. This is evidenced in its status as a founding signatory of the Standards Board for Alternative Investments (“SBAI” [1]) and as one of the first quantitative hedge fund managers to become a signatory of the United Nations Principles for Responsible Investment.

The SBAI was established in 2008 to develop standards related to disclosure, valuation, risk management, governance and shareholder conduct. Winton is represented on the SBAI’s Responsible Investment Working Group, which was formed in early 2020 to help institutional investors and asset managers better understand how responsible investment can be applied to alternative investment strategies, as well as to address specific challenges in the application of responsible investment approaches.

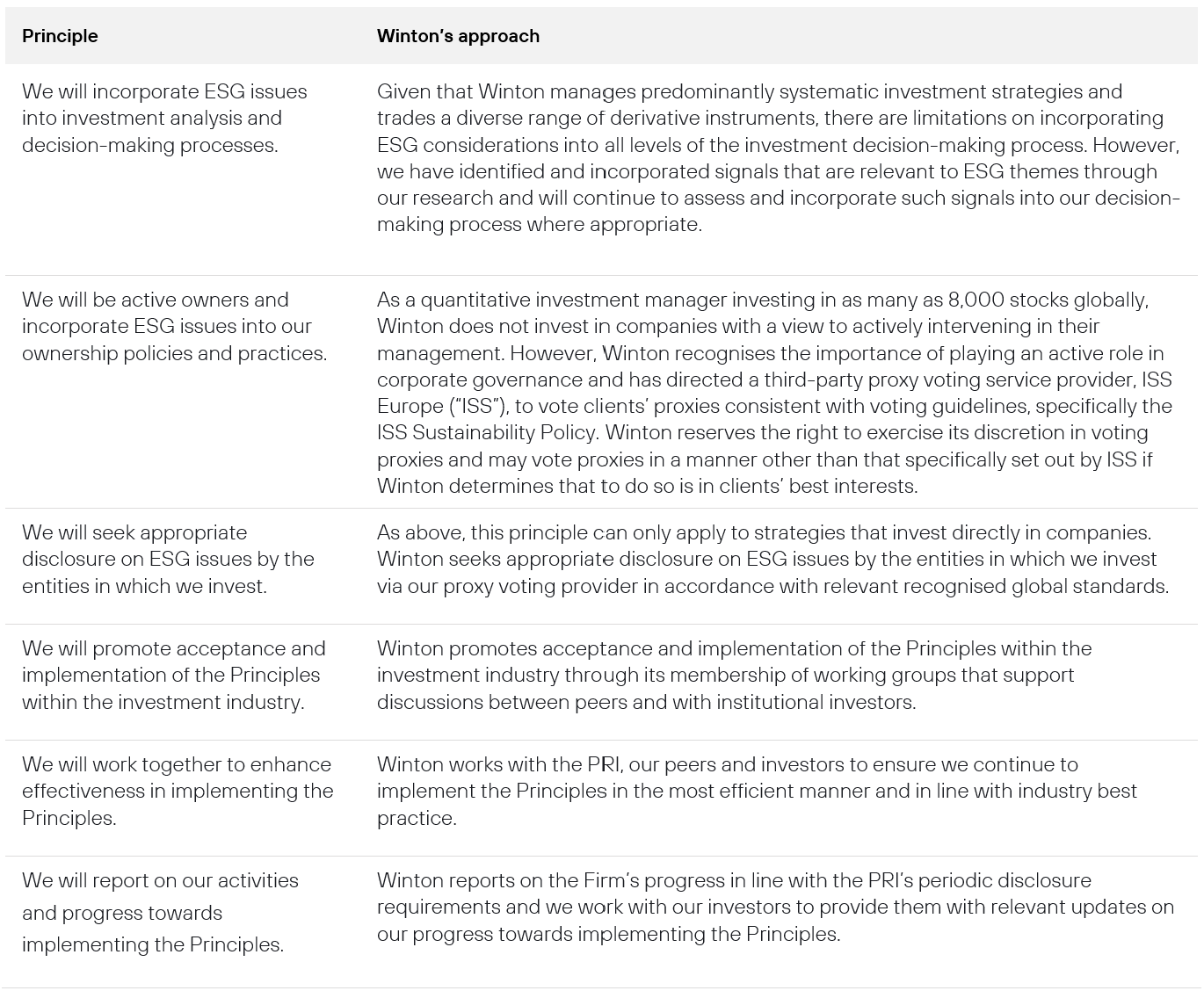

In March 2014, Winton became a signatory to the PRI. The PRI initiative is an international network of more than 3,800 signatories representing global asset owners and asset managers. PRI signatories publicly commit to adopting and implementing an aspirational set of investment principles for incorporating Environmental, Social and Governance (“ESG”) issues into investment practice. Winton has applied the six principles as follows:.

In line with the principles above, Winton requests publicly available corporate and social responsibility documentation from counterparties and service providers prior to their engagement and periodically afterwards. The Firm aims to promote the acceptance and consideration of good practice across the investment industry.

Asset selection

Much of the early focus on responsible investment concerned the application of ESG considerations to corporate single-issuer securities. This led to certain investment strategies emerging as more obvious candidates for the incorporation of ESG considerations, for example, long-only equity portfolios. Integrating ESG considerations in other types of strategies, such as those that trade derivatives, government bonds and currencies, both long and short, is at an earlier stage of maturity.

Winton views the integration of ESG considerations as an opportunity to develop existing models, improve risk management and identify new investment signals. The Firm reviews how ESG-related inputs and instruments can enhance its investment performance on an ongoing basis across the relevant asset classes.

ESG Integration in Equities

Winton’s ESG integration in equities spans three axes: 1) ESG-related investment signals identified through the Firm’s fundamental equity research; 2) negative screening; and 3) the inclusion of ESG-related exposures.

1. Investment Signals: Winton’s research process is designed to discover profitable investment strategies, while mitigating selection bias. This process has, over time, identified signals that are related to ESG themes, particularly within fundamental equity research. For example, we trade several non-traditional governance-related signals that aim to take long (short) positions in well-run (poorly run) companies and one signal takes short positions in companies embroiled in scandals that are often environmental or social issues. These signals are traded within Winton’s Multi-Strategy investment programme and applied to appropriate subsets of the Firm’s global equity universe.

2. Negative Screening: Winton has for many years offered negative screening to reflect investor preferences in managed accounts and single-investor funds where Winton acts as the investment adviser or sub-adviser. In addition, such accounts may incorporate client-specific exclusions or other restrictions, in each case subject to investment management and operational considerations. Additionally, Winton systematically screens for companies that have ties to cluster munitions, landmines, biological and chemical weapons, depleted uranium weapons, blinding laser weapons, incendiary weapons, and/or non-detectable fragments. The screening applies to long and short positions for listed equities, public corporate debt and derivatives on underlying companies.

ESG Integration in Derivatives

There are few established industry norms with regards to incorporating ESG considerations when investing in derivatives, such as futures, forwards, interest rate swaps and credit default swap indices. The reason for this is that the effect that the investment manager’s trading has on the underlying asset is limited by the indirect exposure these instruments provide. As a result, Winton’s ESG integration in derivatives is limited to the inclusion of ESG-related exposures, particularly in emerging ESG-related futures markets, which are traded directionally. Winton does not impose restrictions on long and short positions in markets traded via derivatives.

For example, futures contracts on EU carbon emission allowances were added to Winton’s portfolios from 2018. The EU Emissions Trading System provides a market-based tool to assist in reducing the European Union’s greenhouse gas emissions and Winton’s trading of futures linked to this market contributes to the price discovery process. Futures tied to similar carbon emission allowance markets in the UK and California have since been added to Winton’s portfolios that trade alternative markets.

Another area of development is the emergence of ESG-screened stock index futures, which were added to Winton’s CTA portfolios in 2022. The liquidity offered by these markets is limited at present but Winton’s trading of them, if only with a small weight, contributes to their development.

ESG Integration in Credit

Winton systematically screens its single-name credit investment universe for companies that have any ties to cluster munitions, landmines, biological and chemical weapons, depleted uranium weapons, blinding laser weapons, incendiary weapons, and/or non-detectable fragments.

ESG Integration in Other Asset Classes

Winton’s approach to ESG integration beyond equities, credit and derivatives involves staying abreast of the latest industry developments with a view to incorporating such considerations as and when possible. Any integration will be tailored to the asset class and the style of investment strategy.

Asset ownership

As a quantitative investment manager investing in as many as 8,000 stocks globally, Winton does not hold concentrated equity positions or invest in companies with a view to actively intervening in their management. As a result, the Firm does not have direct contact with the companies in which its strategies invest. Winton recognises, however, the importance of playing an active role in corporate governance. The Firm has therefore partnered with a leading corporate governance research service, ISS, to provide proxy voting guidelines and to vote proxies on its behalf.

ISS’s Global Voting Principles guide its work to assist institutional investors in meeting their fiduciary requirements with respect to voting, by promoting long-term shareholder value creation and risk mitigation at their portfolio firms through support of responsible global corporate governance practices. Winton has instructed ISS to conduct its proxy voting activity based on a sustainability framework that generally takes its frame of reference from internationally recognised sustainability initiatives[2]. These initiatives have regard to: stewardship of the environment, fair labour practices, non-discrimination and protection of human rights.

While Winton will generally rely on the recommendation of the proxy advisor, it reserves the right to exercise discretion in voting proxies. Winton’s Proxy Voting Policy and a record of all proxy votes cast on behalf of its clients are available to investors and potential investors on request.

Winton’s Stewardship Code Disclosure is available via Winton’s website www.winton.com.

Accountability and responsible implementation

Winton’s quantitative investment strategies are implemented by computer programs but are designed and managed by people. The Firm places significant emphasis on its investment professionals acting with the highest legal, ethical and professional standards.

These professionals − who include Winton’s CIO, strategy managers and investment operations staff − are responsible for ensuring that: 1) the Firm acts responsibly in the markets; 2) the Firm is making investment decisions that comply with clients’ investment mandates; and 3) any trades are in line with expectations for each investment strategy.

To that end, a key aspect of Winton’s monitoring programme is measuring the market impact of its investment strategies, and that of other market participants operating similar strategies. In doing this, Winton aims to identify investment risk factors. These include market event risk, which is the possibility that an unforeseen event such as a natural disaster could cause sudden and extreme trading losses; and systemic risk, which includes the risk of overcrowding in specific markets or trades that could lead to market dislocation and take steps to mitigate such risks.

Winton builds large and diverse portfolios of assets, which gradually and continuously adjust their exposures in response to macro- and micro-economic input data. To maximise portfolio diversification, most of Winton’s strategies’ risk is taken in the world’s major futures markets and exchange-traded stocks. Liquidity of the underlying markets and securities, meanwhile, is monitored by our strategy managers. Markets that fail to meet the necessary criteria are removed until conditions improve. Winton believes that its participation in a wide range of markets contributes positively to well-functioning financial markets by providing liquidity and aiding price discovery.

Responsible investment policy governance

Winton’s ESG Committee is chaired by the Firm’s Chief Operating Officer and is responsible for overseeing the implementation of the Firm’s ESG strategy, including responsible investment, by relevant departments and reviewing the effectiveness of internal processes, policies and procedures where relevant to ESG matters.

In turn, the ESG Committee has assigned responsibility for the implementation of each aspect of the Responsible Investment Policy to the appropriate teams within the Firm. Senior level oversight and accountability is provided by Winton’s senior management team and through its relevant governance meetings.

[1] Known as the Hedge Fund Standard Board until 2017.

[2] https://www.issgovernance.com/file/policy/active/specialty/Sustainability-US-Voting-Guidelines.pdf