6 April 2017 | 6 min read

The Sweet and Sour History of Sugar Prices

Meanwhile, this month, a trade spat broke out between the US and Mexico. At the centre of the flare-up was sugar. Speculation and international politics have both been major factors in the tumultuous, millennium-spanning history of sugar’s trade on the world market. The following episodes in the history of sugar prices show how, for humanity’s sweet-tooth, pleasure and terrible suffering have often been intimately intertwined.

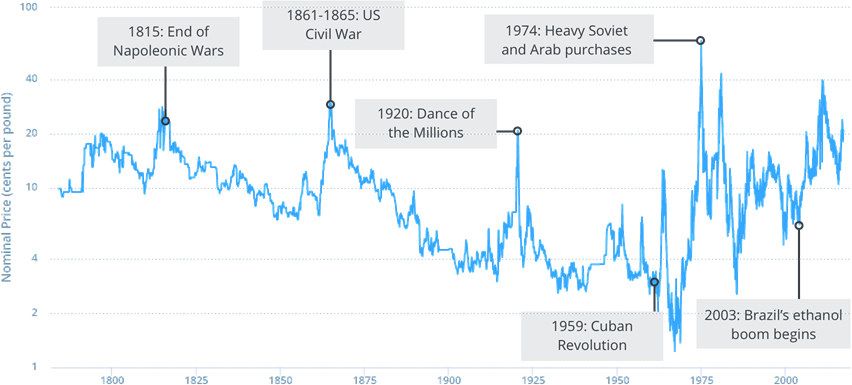

The Price of Sugar (1784 - 2017)

Swimming Pools of Sugar (2006-16)

Between mid-2015 and mid-2016, the price of sugar doubled. A major beneficiary of this swing was Wilmar International. A palm-oil producer, the company has, according to one report, bought ‘more than 6 million tons of sugar…since 2015, enough to fill roughly 3,000 Olympic-size swimming pools at a cost of some $2.3 billion.’ Bad weather and a weak dollar helped boost the commodity's price. Swings like last year’s are not new to the world sugar markets. Following decades of relative calm, the last 15 years have seen major ups and downs in the price of sugar. Looking farther back, the fortunes of consumers worldwide have sloshed for centuries in the swimming pools of sugar traded on world markets every year.

Weather patterns and Brazil’s allocation of its sugar to ethanol production have been recurring factors over the last decade. In 2006, for instance, the sugar price passed 20¢/lb before rapidly falling. Observers of the Brazilian crop in particular called sugar futures the ‘Pop Rocks of the commodities world’ in that year. Then, in 2009-11, the price hit highs not seen since the early 1980s as adverse weather from India to Brazil delivered lower than expected supplies amid diminished stockpiles and the ongoing ethanol boom. Weather and changing sources of demand have not been the only important factors in sugar's long, bittersweet history, though. Just as crucial have been slave labour, war, and changing production techniques.

The Queen of Cavities (1226-1790)

Humanity’s love affair with sugar goes back over two millennia. Ancient Sanskrit texts offered sugary recipes. In the Early Middle Ages, Arabs spread the sugar cane plant across the Mediterranean. Soon, Crusaders brought it back to Britain, and the trickle of the plant, known for its medicinal qualities, slowly increased to the north. British elites adopted sugar, imported from Venice, as a luxurious addition to their banquets.

As early as 1226, Henry III is known to have made a request for three pounds of sugar. From then on, the quantities of sugar on royal tables only grew. A few centuries later, a German visitor noted how Queen Elizabeth I’s teeth were blackened from her sugary diet, ‘a defect the English seem subject to.’ By this time, sugar was an important vehicle for conspicuous consumption. A banquet thrown in honour of that queen of cavities featured sugary sculptures depicting everything from soldiers, castles and drummers to mermaids, unicorns, oysters and frogs.

This saccharine decadence fell out of style among the British elite. But sugar consumption soon took off anyway with the rise in popularity of bitter drinks like coffee and tea. Sweetened with sugar and increasingly available, they entered the daily routines of a growing fraction of British society, which could consume them in the burgeoning number of coffee houses popping up across London.

To satisfy rising demand, European powers sent African slaves to their West Indian colonies, extracting 12 million tonnes of sugar—and destroying countless human lives—between 1690 and 1790. This was the infamous ‘triangle trade,’ where Europeans sent manufactured goods to Africa, slaves were sent from Africa to the West Indies, and the West Indies sent commodities like sugar to Europe. Disagreements over sugar taxation in this web of trade were an important driver of tensions between Britain and its American colonies that ultimately led to war.

As Europeans grew accustomed to inexpensive sugar, the prospect of a supply disruption became a growing liability for governments. During the Napoleonic Wars, British blockades left Continental Europe starved of sugar. To replace the lost source of sweetness, Napoleon directed the creation of a domestic beet sugar industry.

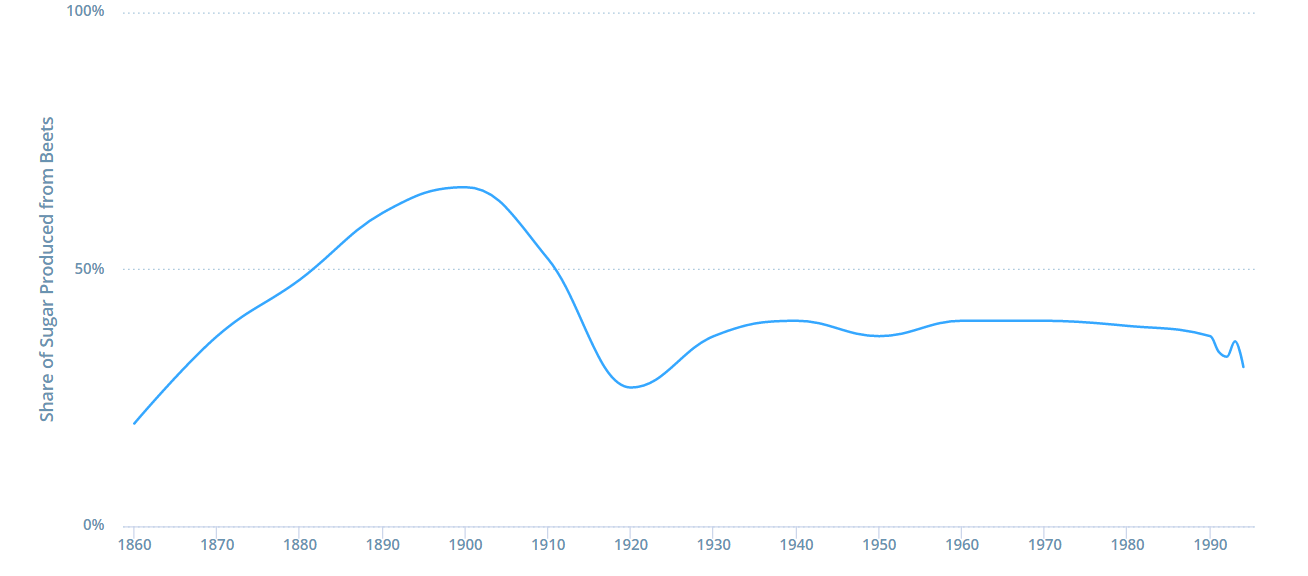

The production of sugar from beets was a recently developed process. The first European beet sugar factory opened in 1801. By the tail end of the Napoleonic Wars, 300 French factories were producing nearly eight million pounds of beet sugar. An advantage of beet sugar to some was that its production was not tainted by the institution of slavery. In Britain, for instance, Quaker abolitionists tried to spur a beet sugar industry, with little success.

As for Napoleon’s beets, as the blockade ended and trade with the West Indies reopened, the price of sugar fell. This supply shock decimated the nascent European beet sugar industry, but it recovered by the middle of the century. Around the turn of the 20th century, beet sugar output even eclipsed that of cane sugar.

The Rise and Fall of the Beet (1860 - 1994)

Sweet Freedom (1861-69)

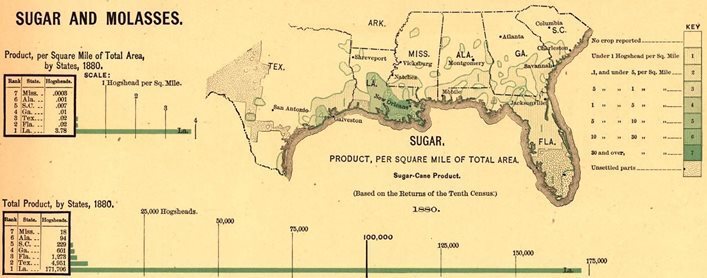

During the American Civil War, domestic sugar supplies crashed as slaves abandoned Louisiana sugar plantations. With over one tenth of the world’s sugar supply taken offline due to the war, and the failure of the French beet sugar crop, prices spiked from 7¢/lb in 1861 to over 20¢ in 1864.

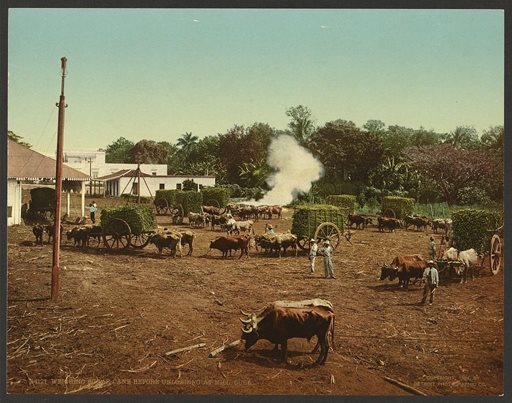

While the institution of slavery was destroyed by the Union army in the US, it persisted in Cuba. But Cuban slaves’ fortunes soon turned, as a plantation owner fed up with Spanish colonial rule freed his slaves and revolted, starting a war that would last ten years and result in the emancipation of slaves over the coming decades. In the spring of 1869, speculators took advantage of this upheaval by attempting to corner the sugar market, predicting that the conflict would decimate the animals used to harvest and process Cuban sugar.

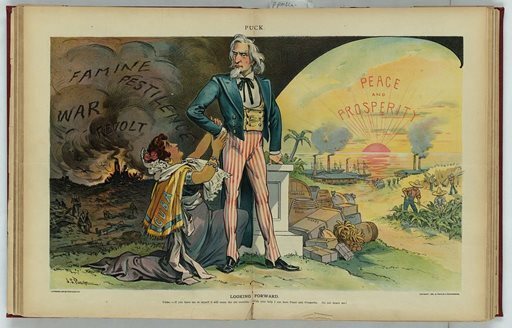

Amidst rising prices, the New York Times fretted that ‘like the Americans of the days of the Revolution and of the era of the War of 1812, those of the present generation must forego their usual dessert, and use with sparing hand the saccharine substance with which they have been accustomed to sweeten their morning coffee and evening tea.’ While some believed ‘we can’t have cheap crushed sugar without crushed rebellion or crushed Spanish domination,’ others saw the upheaval as an opportunity for Americans to start cultivating beets, as the Mormons had attempted unsuccessfully in Utah in the 1850s, and as Napoleon had accomplished in France. ‘Surely no patriotic Yankee will submit to be outdone by a Frenchman,’ one Yankee wrote.

While the beet sugar industry took off slowly, by 1902 American factories were producing over two million tons of sugar annually. The US also continued to rely heavily on Cuban supply, and American investment in the island’s sugar industry expanded dramatically. In the decades following the Civil War, the price of sugar fell steadily, as production techniques and relative peace boosted supply.

Dance of the Millions (1920)

‘The wildest year in the history of sugar.’ That’s how the New York Times described 1920. ‘Millionaires were made overnight. Everybody was speculating wildly.’ In what became known as the ‘Dance of the Millions,’ speculators drove up the price of sugar and related Cuban assets. It was a candy bubble that popped almost as soon as it grew.

During the First World War, Allied governments had coordinated to control the price and distribution of sugar. Following the end of hostilities, in the US, the cost of sugar held at the government-set price of roughly 7¢/lb throughout much of 1919. Meanwhile, Congress deliberated about whether to buy the 1919-20 Cuban sugar crop or liberalise the market. A speculative frenzy in sugar ensued as the federal government declined to purchase the crop and controls fell by the wayside amidst a global shortfall of sugar, caused by bad weather and wartime disruptions. The price of sugar nearly tripled to almost 21¢/lb in May of 1920, before crashing to just over 5¢ by the end of the year. As the sugar price went sky-high, so did Cuban property values. American firms invested millions in production on the island. When the price crashed with the return of European beet sugar to the market, loans taken out based on the inflated sugar price went sour, driving a financial crisis in Cuba. American banks took over a number of Cuban sugar plantations.

‘The nickel bar of candy is headed either for extinction or a drastic reduction in size,’ the New York Times warned amidst a sudden increase in the price of sugar. After the 1920 crash, with world production steadily rising, prices stayed relatively flat until the 1960s. But following the 1959 Cuban Revolution, the US banned imports from its island neighbour, depriving Americans of their most important source of sugar. With that disruption, a general production shortfall in 1963—including in Cuba, where production had crashed by half since before the revolution—and rising global demand, prices spiked. The USSR, which bought up the Cuban sugar spurned by the US, unexpectedly refused to dump it on the world market, reducing further the expected supply. ‘By thus sweetening the Russian’s life, Mr. Krushchev may perhaps hope to be forgiven for his failure to carry out other promises,’ the Chicago Tribune explained drily.

The abruptness of the increase led the US Agriculture Department to warn of a ‘speculative bubble,’ and the US Senate was pressured to investigate as consumer prices rose throughout the country on items like ‘soft drinks, bread, rolls, pastries, and buns, sweet pickles, jams, syrups, and canned fruit.’ The Los Angeles Times felt the need to offer its readers an explanation of the difference between a spot and futures market, saying that the sugar crisis had made world commodity markets newly relevant to ordinary Americans.

Newspapers noted echoes of the ‘Dance of the Millions.’ ‘Although sugar is a commodity particularly sensitive to political crises,’ the New York Times noted, ‘both the 1963 and 1920 markets occurred in time of peace and were not influenced by world crises.’ In each case, rumours of shortages led suppliers to hold onto their sugar in the hope of a higher price, restricting supply and driving demand from cautious participants wanting to stockpile.

Coke Gets Corny (1972-82)

Equilibrium returned, but prices spiked again twice in the succeeding two decades. In 1972, supply shortfalls, rising demand, unrest in Pakistan, and the devaluation of the dollar all contributed to a large increase in the price of sugar, rising from 5¢/lb in December of 1971 to 9¢ in March 1972. At the time newspapers called it an ‘almost vertical rise in sugar prices.’ But that was nothing compared with what was to come. By February of 1974, thanks to rising inflation, anticipation of rising demand from China, rumours of a large purchase by the USSR on global markets, large purchases by Arab nations, a bad European harvest, and the perception of imminent shortages, the price of a pound of sugar broke 20¢/lb, before sprinting to over 65¢ in November. Later reports also claimed that the Russians had speculated on the futures market in anticipation of these rises. Outrage at the sugar refiners’ newfound profits became widespread, and the US federal government opened investigations into price-fixing.

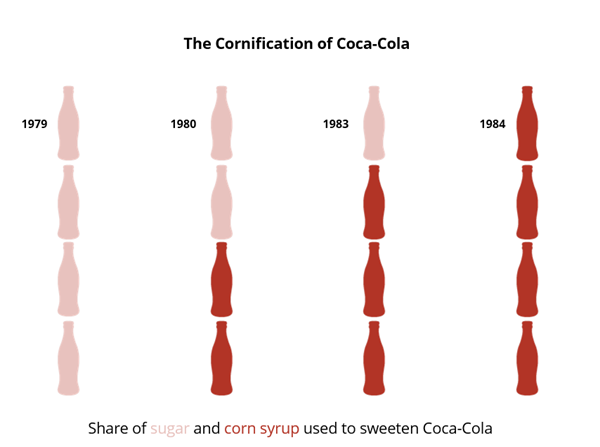

In the face of unprecedented prices, nutritionists were giddy at the prospect of a pullback in consumption, but the president of Waldbaum Supermarkets was sceptical: ‘Sugar happens to be the most delicious food there is, it seems, and people want to indulge themselves.’ His confidence was misplaced. US per capita consumption of refined sugar fell indeed, from 103 pounds in 1973 to 90 in 1975. The price spikes in sugar stimulated interest in alternative and artificial sweeteners. Little surprise that in 1974 Coca-Cola moved to allow high-fructose corn syrup in sodas like Sprite and Fanta. The tumult in the sugar market captured people’s imaginations as it altered their beverages. A movie was even released four years after the fact about a bureaucrat trying to profit from it, called Le Sucre, starring Gérard Depardieu.

After falling from its highs thanks to supply increases, the price of sugar again spiked in 1980 due to crop shortfalls in Russia and Cuba. In October 1980, futures for March delivery reached over 45¢/lb, up from under 14¢ in the same month of the previous year. Hershey’s confirmed sugar addicts’ fears by reducing the size of popular products like Kit-Kats and Reese’s. Coca-Cola finally allowed bottlers to use corn syrup to sweeten their flagship product, permitting up to a 50% share. And newspapers offered sugar-free dessert recipe—for example, ‘sugarless spicy raisin bars’—to cash-strapped, sweet-toothed readers.

Soon, prices crashed, to under 6¢/lb in October of 1982, thanks to a weather-induced bumper crop. Following the wild ride of 1963-82, the sugar market calmed down starting in the 1980s as developed countries accounted for a rapidly falling share of global sugar imports. This was in part due to the substitution of alternative sweeteners for sugar by companies haunted by the recent price spikes. The more price-conscious developing countries were not as receptive to large price increases on the world market, reducing volatility. This newfound moderation did not last long. Price swings in the 1990s foreshadowed the rollercoaster ride sugar would take in the 21st century. Market participants familiar with the complex collisions of politics, animal spirits and meteorology that have characterised sugar’s history were likely better prepared for it.