29 April 2019

The Mississippi Bubble

When the Scottish financier John Law claimed to be able to transmute paper into money, France’s Regent allowed him to conduct an experiment on the French economy. Law ’s unalloyed successes quickly enlivened the mercurial temperaments of Parisian speculators, but when the bubbling stock overflowed in January 1720, liquidations rapidly occurred and the economy sank into inertia.

The Philosopher’s Stone

John Law, a financial theorist, gambler and convicted murderer, originally from Edinburgh, presented the new regent in 1716 with a system which, he claimed, would restore France’s prosperity and revolutionise her monetary and fiscal systems.

Given that France had been left virtually bankrupt by the prodigality of its last king (Louis XIV), the regent was open to any suggestions for getting the economy back on track and bade Law proceed.

Law’s ultimate ambition was to replace the metallic currency with a paper currency based on government debt that had been converted into company shares. This circulating debt would provide companies with a ‘fund of credit’ which could be used as equity against commercial ventures.

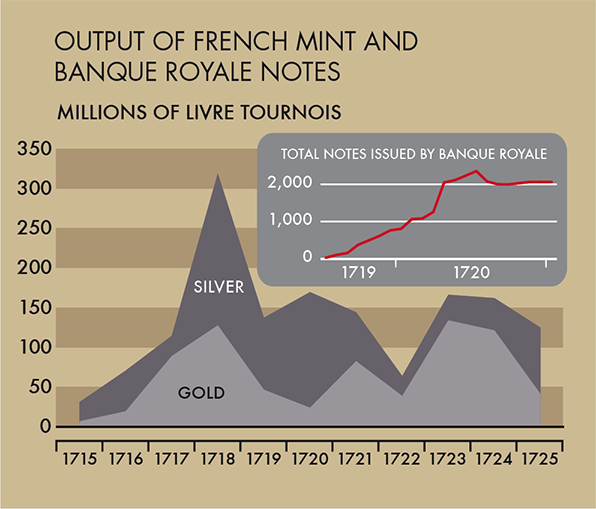

He also considered paper a better medium of exchange than metal, being easier to handle and quick to print. This monetary system would take time to realise, so in the interim, he established the Banque Générale in May 1716, whose more limited remit was to issue paper notes which would be redeemable in gold or silver.

The notes gained immediate popularity and stimulated commerce throughout France, convincing the regent of the genius of Law and the soundness of his scheme. Law sought also to restore France’s commercial vigour by developing trading links with her colonies and overhauling her fiscal system.

In August 1717, having secured a trading monopoly over Louisiana and French Canada, Law founded the Mississippi Company.

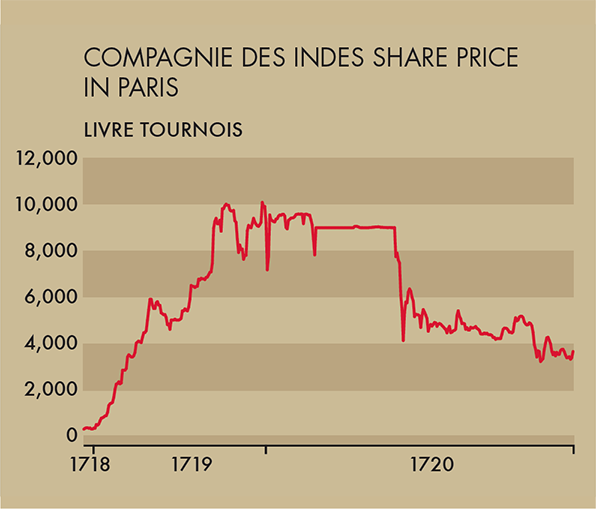

Rumours of precious metals in Louisiana, generous dividends and Law’s personal celebrity guaranteed the company investor interest from the outset and when the regent granted Law further monopolies in the East Indies, China and the South Seas in early 1719 and Law issued 50,000 new shares, his hand was almost bitten off.

Stirring the Cauldron

Such was the enthusiasm for the first issue that the regent authorised a much larger issue of 300,000 shares, whose proceeds could be used to pay off the whole of the national debt.

Taking advantage of the Banque Royale’s stock loans, investors descended upon Law’s residence in Rue de Quincampoix and started a piranha-like feeding frenzy upon the Mississippi shares, where commoners jostled with the nobility for a scrap of succulent stock.

Aristocrats who would not have waited half an hour for the Regent waited six hours for a moment’s word with Law.

Those who could afford it took apartments in the neighbourhood, where rents increased sixteen-fold: indeed, space was at such a premium that an elderly hunch-backed man was able to make substantial sums by lending his hump as a writing-desk to speculators.

Soon the crowds became so riotous and the congestion so intolerable – soldiers were needed to clear the street each night – that Law was compelled to move to the more palatial environs of the Hôtel de Soissons.

Even there, the seething multitudes of investors stuck to him and encamped in its gardens, erecting hundreds of tents along with refreshment stalls and such varied amusements as roulette wheels.

As the mania progressed, so did the lengths to which people would go to attract Law’s attention and acquire Mississippi stock – a fact which did not escape the notice of the regent’s mother, who lewdly observed that if duchesses were prepared to kiss Law’s hand what other part of his body might other ladies not favour?

At one point, a lady instructed her coachman to overturn the carriage as Law was walking past, as a pretext for requesting some shares; on another occasion, a lady cried ‘Fire!’ at a house where Law was known to be dining.

More generally, Mississippi stock was always on people’s minds. There is a story of a doctor who, feeling a lady’s pulse, muttered ‘It falls! It falls! Good God! It falls, it continually falls!’ whereupon she rang for assistance and cried ‘I’m dying! It falls! It falls! It falls!’ The puzzled doctor asked ‘What falls?’ and when she said ‘My pulse! My pulse! I must be dying’, the doctor explained he was referring to his shareholdings, which were currently incurring losses.

Ennobling Base Matter

The mania also wrought profound social changes. Maids, servants and charwomen flaunted their new-found wealth but kept the manners and language of their former station.

There were reports of footmen standing up behind their own carriages, and a baker who sent the contents of a jeweller’s shop to his wife with directions to arrange the articles properly for supper.

Conscious of their low birth, many arrivistes sought to buy themselves into the aristocracy. One particularly desperate jobber offered his 3-year-old daughter in marriage to a 33-year-old marquis, sweetening the deal with a hefty lump sum and an annual allowance.

The mania was also accompanied by a shocking rise in violent crime, even in the highest echelons of society. In one instance, a distant relative of the regent murdered a wealthy jobber with a view to stealing his Mississippi stock, but was apprehended and condemned to death by being broken upon the wheel.

John Law

John Law was born in 1671, the son of a successful Edinburgh goldsmith.

He moved to London in 1692, where he became a compulsive gambler and killed his neighbour in a duel. Sentenced to death, he escaped from prison and fled to Amsterdam, the capital of world finance at the time.

Law was deeply impressed by Dutch financial innovations such as short-selling and windhandel, but thought that the Amsterdam Exchange Bank was too conservative and could not understand why so popular an institution as the East India Company did not issue more shares.

It was there that he developed the theories on money and trade that would later be implemented in France with such disastrous consequences.

In 1705, Law approached the Scottish parliament with a proposal to establish a new bank which would obviate the need for coinage by issuing interest-bearing securities to be circulated as currency; but this plan was rejected.

A few years later, he approached the Duke of Savoy with a similar proposal, but was sent home empty-handed.

His big break came in 1716 when the Duke of Orléans, Regent of France, agreed to his plans. Over the following four years Law assiduously implemented his grand designs.

In December 1719, Law publicly converted to Catholicism, hoping to cement his favoured status amongst the French nobility, and was duly appointed Controller-General of Finances – a key position in the Ancien Régime.

However, he remained an inveterate gambler and made a bet with Lord Londonderry in August 1719 that East India Company stock would weaken over the following year.

He lost. It was this wager and not the collapse of the Mississippi bubble that ruined Law.

On 28 December 1720, he fled France disguised as a woman and died in Venice nine years later, a poor man.

Breaking the Law

Then the wind changed. In mid-January 1720, the share price began to fall, due to increasing attempts by investors to convert capital gains into gold.

The shrewder jobbers realised that prices could not continue rising indefinitely and started to liquidate their holdings, sending the proceeds abroad.

Such liquidations were not looked upon kindly by the authorities, obliging jobbers to be extremely discreet: one jobber managed to escape detection only by hiding his gold in an old cart, covering it with dung, and driving to Belgium dressed in a tatty farming smock.

In view of the falling share price, Law and the regent introduced a number of measures intended to support the share price and maintain the façade of note convertibility.

His first act was to proscribe gold payments of over 100 livres, but when this proved insufficient, they took the drastic step of banning all payments in coin and prohibiting the possession of more than 500 livres in coin, with severe punishments for non-compliance.

As the share price continued to decline, he set a floor price of 9,000 livres on 5 March, by instructing the Banque Royale to exchange its notes for company stock to absorb sales.

This monetisation of shares was the realisation of Law’s vision that a company could be funded by emissions of circulating debt. However, as metallic currency had by this time all but disappeared, these paper money expansions resulted in galloping inflation.

The authorities also attempted to arrest the share price decline by conscripting 6,000 ‘poor wretches’ to parade around the streets of Paris carrying mining equipment to give the impression that the Company had struck gold, though the effect proved transitory.

By mid-May, inflation had become so severe that Law attempted to force deflation. On 21 May, he proposed devaluing the notes to 50% of their face value and lowering the peg in seven stages from 9,000 to 5,000 livres, ending in December.

This was met with such public fury that the proposal was scrapped and Law was dismissed from his post as Controller-General at the end of the month.

On 1 June the detested edict which criminalised the possession of more than 500 livres in specie was also abolished and a batch of new notes – secured on the city of Paris’s revenues and intended to replace Law’s notes – was issued.

Nine days later, the Banque Royale was reopened and resumed specie payments. These last developments proved highly popular.

Virtually the whole of Paris turned up at the bank to convert their stricken paper money into coin; indeed the crowds were so large that people were crushed to death almost every day.

Finally, in October, edicts were passed which deprived Law’s notes of all value and took away many of the Mississippi’s Company’s privileges, thus completing the destruction of Law’s ambitious system.

By December, the Mississippi’s share price had fallen to 1,000 livres and amidst a wave of convictions against those suspected of having made ‘illegal’ profits during the mania, Law was forced to flee France.

Some argue that the bubble had a favourable legacy: Louisiana saw development under the Mississippi Company, New Orleans was founded, and there was greater research into monetary policy and the nature of money, culminating in Adam Smith’s Wealth of Nations.

However, these benefits were marginal compared to the heavy toll exacted on France and the misery endured throughout Europe by the many investors who had been ruined.

The collapse of Law’s scheme resulted in a widespread revulsion against the stock market and for decades retarded the development of French capitalism and industry.

The Mississippi bubble had also dealt a death blow to the reputation and finances of the monarchy, paving the way for the French Revolution at the end of the century.

Law’s experiments with French finance may have yielded disappointing results but this did not prevent the directors of the South Sea Company from employing many of his discredited techniques to inflate their own stock just months later.

The crucial difference, however, is that whilst the South Sea directors’ intentions were fraudulent, Law was driven by a genuine if flawed desire to revolutionise the nation’s finances.

My shares which on Monday I bought

Were worth millions on Tuesday, I thought.

So on Wednesday I chose my abode,

In my carriage on Thursday I rode

To the ballroom on Friday I went

To the workhouse next day I was sentAnon, 1720