23 May 2017 | 7 min read

Over a Barrel: the Pipedream of Oil Price Stability?

Despite supply cuts initiated by OPEC since January, inventories remain near historic highs and could still fail to fall to their five-year average level by the end of the year, the International Energy Agency declared in its latest monthly market report.

A full historical picture - depicted in the first of the charts below - shows pronounced price cyclicality is the norm. And an examination of more discrete periods of oil price development in the subsequent charts indicates that regulation and cartelisation have rarely delivered meaningful or long lasting control.

1859 - 2017: The Longer View of Oil Prices

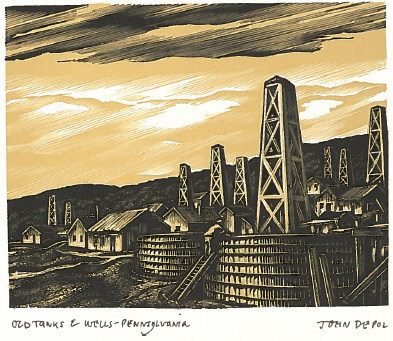

Prices of kerosene – a derivative of crude - dropped precipitously from $20 to 10 cents due to rampant overproduction, as individual producers sought to maximise their exploitation of shared reservoirs. At this price, the whisky barrels containing the oil were worth double the cost of their contents. As cheap kerosene displaced whale oil and camphene as a preferred fuel, prices rebounded to $14 by 1865.

1890 - 1911: Standard's Influence Spreads

1911 - 1931: The Emergence of the Majors

As gasoline was sent to Europe to support the Allied cause in World War I, prices rose, peaking in 1918. This prompted early interest in shale reserves in the West of the United States, but extraction costs were underestimated. The British, meanwhile, attempted to reduce costs by producing ethanol from artichokes. In the event, the high prices facilitated innovations which led to new discoveries, such as in California, relieving the shortage. The dominant handful of oil majors – the likes of Texaco, Humble Oil and Shell Petroleum - agreed to fix their existing production ratios outside the US to avert undercutting.

1931 – 1971: The Texas Railroad Commission Holds Sway

Even the period of history that holds the best claim for relatively stable prices experienced some volatility. When Dad Joiner discovered oil in East Texas in late 1930, the supply was so vast that the Texan price fell from $1.85 to 10 cents, threatening competitive suicide for the whole industry. The US government duly charged the Texas Railroad Commission with managing domestic production.

Prices rose strongly, if steadily, following the postwar automobile boom and reconstruction efforts in Europe and Japan. But a quota programme introduced by President Eisenhower in 1959 to prevent imported oil flooding the US market eventually became highly distorted - a contributing factor to the 1973-4 US oil shortages.

1971 – 2003: OPEC Takes Over From TRC

In 1971, OPEC negotiated a higher posted price and a 55% minimum profit share in the Tehran Agreement. But the dollar’s falling purchasing power after the 1971 Nixon shock had already put a big strain on the Agreement’s fixed posted prices. US support for Israel during the October 1973 Yom Kippur War was the final straw. A resulting embargo lasted until March 1974, but after it was removed low and stable posted prices failed to return.

Instead, high prices drove efficiency gains. People began to drive lighter and less powerful vehicles, and engine technology improved. US consumers drove less during these years and NASCAR reduced its lap distance by 10%.

Oil reached a low of $10 per barrel during the 1997 Asian financial crisis. The price collapse encouraged industry consolidation: the huge mergers included BP-Amoco, BP-Arco, Exxon-Mobil, Chevron-Texaco and Conoco-Phillips.

2003 – 2017: OPEC Loses Control

Looking Ahead: Peak Oil, Tight Oil or Neither?

A better energy source may one day supplant oil, as oil supplanted coal, which in turn supplanted wood. And it is likely that crude will soon play a less significant role in global energy production.

Price rises have often been accompanied, however, by the fear that the world is running out of oil. The reasoning is that oil's characteristic as a finite resource should make it more expensive, the more of it is consumed - particularly once ready supplies have been exhausted. But oil is unlikely to run out, especially if one broadens the definition to include tight oil, oil shale and tar sands. Storage costs aside, the real cost of oil is today in line with where it stood in 1870.

Price cyclicality has made oil a trying long-term investment. John D. Rockefeller tried speculating in the 1860s – he created a vast lake of oil, calculating that he would be able to sell it for a premium when his competitors’ supplies were depleted. Unfortunately, his first consignment exploded, and the rest evaporated at a rate of 1000 barrels/day. The dire shortage never came.